The Used Car Market Has Finally Reached Its Peak, as Prices Fall After Two Record-Breaking Years of Inflation

Across most segments and brands, used car prices are starting their long road back to normal, with the biggest-ever monthly drop in price premiums.

As dealers race to maintain strong sales in the face of slackening demand, consumers are starting to see used car prices trend closer to affordable levels.

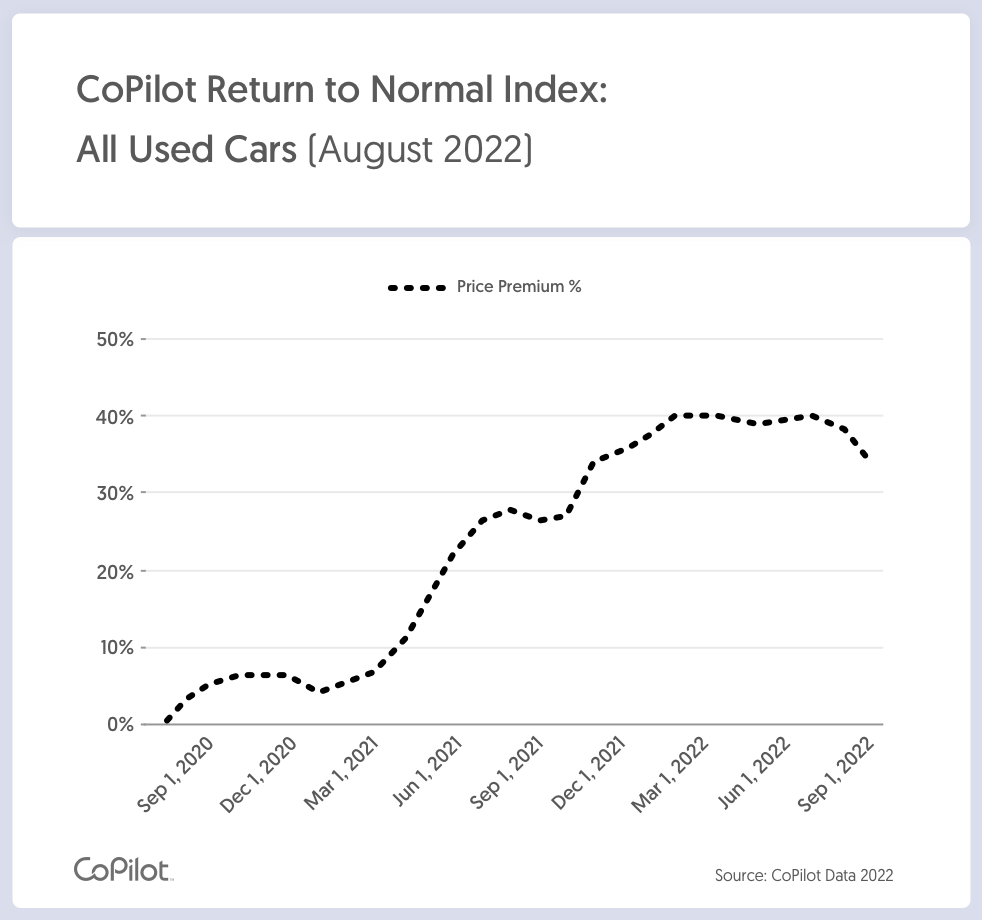

Chicago, IL – September 7, 2022 – After used car prices rose to all-time highs amid the COVID-19 pandemic and resulting supply chain disruptions – and even held firm amid multiple interest rate hikes this year – the market has finally peaked, according to the monthly Return to Normal index from leading car shopping app CoPilot.

Overall used car prices fell in August to an average of $33,414, as dealers dropped prices across the board to maintain sales momentum. Prices are now $8,497 (or 34%) above projected normal levels, a premium that fell by a staggering 9% from July – the largest-ever monthly drop for CoPilot’s index.

Most segments and brands have dropped in price after reaching record highs in recent months. CoPilot’s Return to Normal Index shows the price premium, or the differential between current listing prices and what the same used cars would have been worth, if not for the COVID-19 pandemic and other unprecedented events of the past two years. This provides a unique measure of the relative inflated value of vehicles for American consumers, and a new economic barometer for the retail used car market.

Across all age brackets, prices declined in August, and this trend was seen most prominently in the prices of 1-3 year old vehicles. While, for much of this year, nearly-new car prices remained near all-time highs (as consumers turned to them as a substitute amid record-low new car inventory), they are now falling the fastest of any age bracket, down $715 (or 2%) to $41,545 in August. The Price Premium for these cars fell the most of any age bracket, dropping 7%, from $11,944 (or 39%) in July, to $11,097 (or 36%) in August.

Used SUVs and pickup trucks remain the segments relatively closest to returning to normal pricing levels, with SUVs priced $8,092 (or 23%) above normal, and pickup trucks listed $8,638 (or 26%) above normal. Average used SUV prices - now $43,222 - have fallen for the past six months, while used pickup truck prices - now $41,469 - have seen month-over-month declines for the past four months.

Electric and hybrid vehicles are also reflecting this broader trend within the used car market. As gas prices continued their steady decline in August, used electric and hybrid vehicle prices – which had skyrocketed along with fuel costs in the spring – fell dramatically this month. Used electric vehicle prices declined by 4% from July to August, to an average of $64,306, while used hybrid prices fell by 3%, to $47,790.

Additionally, used Teslas – often seen as a proxy for the electric vehicle market – dropped in price by 4%, or just over $3,000, since last month, to an average of $67,324. After peaking at an all-time high of 50% above projected normal in June, Tesla prices are starting to show early signs of softening, with prices declining in August to 43% above normal levels.

“After years of astronomical price hikes in the used car market, relief may finally be imminent,” said CoPilot CEO and Founder Pat Ryan. “While we’re still a long way from normal prices in absolute terms, across the vast majority of vehicle segments and brands, it’s clear that prices have fallen off their record highs. Consumers who have been waiting out this unprecedented market for months, or even years, should be ready to finally make their move.

“Cars are still moving fast on dealer lots, but as days-to-sale ticks up in recent months, dealers are dropping prices – by hundreds of dollars for nearly-new cars – to keep sales moving in the face of rising interest rates and other economic headwinds that dampen demand,” Ryan added. “The story is evolving, but we recommend shoppers should prepare to strike when they find a car that matches their needs, and be closely looking out for the moment soon when prices may fall off even more substantially. In many cases, buyers will already find they finally have more negotiating leverage at the dealer.”

Some brands, however, continued to hold firmly near all-time high prices in August. On average, foreign brands were priced $8,105 (or 44%) above projected normal levels, a slight increase from last month’s Price Premium of $8,012 above normal. Used Volkswagens had the highest Price Premium among foreign brands, averaging $9,338 (or a massive 57%) above normal pricing levels.

“While most vehicle segments and brands have fallen off their peak prices, some still are lingering near their record-high prices, so it pays to explore alternative brands to find the best value,” Ryan said. “For people with a used car to sell, now is the time to make a move and sell that vehicle at a profit, in order to capitalize on these once-in-a-lifetime market conditions, before prices fall much further on your trade-in.”

About CoPilot

CoPilot is a leading, data-driven car buying app that provides consumers with an expert partner for the high-consideration purchase process starting with car buying and ownership. The platform combines powerful data backed by human expertise to introduce transparency to the shopping, purchasing and ownership journey. The mobile application takes the time, frustration, and guesswork out of the process, empowering people to easily navigate the risks of shopping for high-value items, and to buy with confidence at the right price and the right time.

CoPilot provides free pricing tools for consumers. Price Pulse makes it easy for car shoppers to check the current market value and Price Premium for any car, track price changes, and compare years and models to choose the right car and know when to buy. For car owners and sellers, Price Pulse calculates the real-time value of their car, using the same data only dealers used to have, allowing consumers to track how much their vehicle has appreciated, so they can decide whether and when to sell, or negotiate the best deal at trade-in or lease-end. For media publishers, CoPilot offers embeddable data tools, allowing journalists and bloggers to integrate interactive charts within their web content, apps, or newsletters, powered by CoPilot’s unique data and analytics.

Media Contact:

Kerry Close

732-609-2644

Popular Car Searches

Makes

Shop Used Cars

Used Toyota Truck for Sale Near Me

Used Honda for Sale Near Me

Used Subaru Forester for Sale Near Portland, OR

Used Honda Pilot for Sale Near Me

Used Honda Minivan for Sale Near Me

Used Hyundai Suv for Sale Near Me

Used Honda Civic Hatchback for Sale Near Pittsburgh, PA

Used Toyota Camry for Sale Near Tulsa, OK

Used Ford Mustang for Sale Near Jacksonville, FL

Used Volvo Convertible for Sale Near Me

Used BMW Crossover for Sale Near Me

Used Ford Bronco for Sale Near Winter Haven, FL

Used Subaru Hatchback for Sale Near Me

Used Nissan Murano for Sale Near Trenton, NJ

Used Ford Fiesta for Sale Near Me

Used Ford Transit Van for Sale Near Fort Worth, TX

Used Mercedes-Benz Hatchback for Sale Near Me

Used Nissan Roadster for Sale Near Me

Used Nissan Pathfinder for Sale Near Boise, ID

Used Acura Sedan for Sale Near Me

Used Subaru WRX for Sale Near Minneapolis, MN

Used Honda Accord Sedan for Sale Near Sarasota, FL

Used Chrysler Wagon for Sale Near Me