CoPilot’s Return to Normal Index

September 2022 Report

EXECUTIVE SUMMARY: AUGUST 2022 DATA

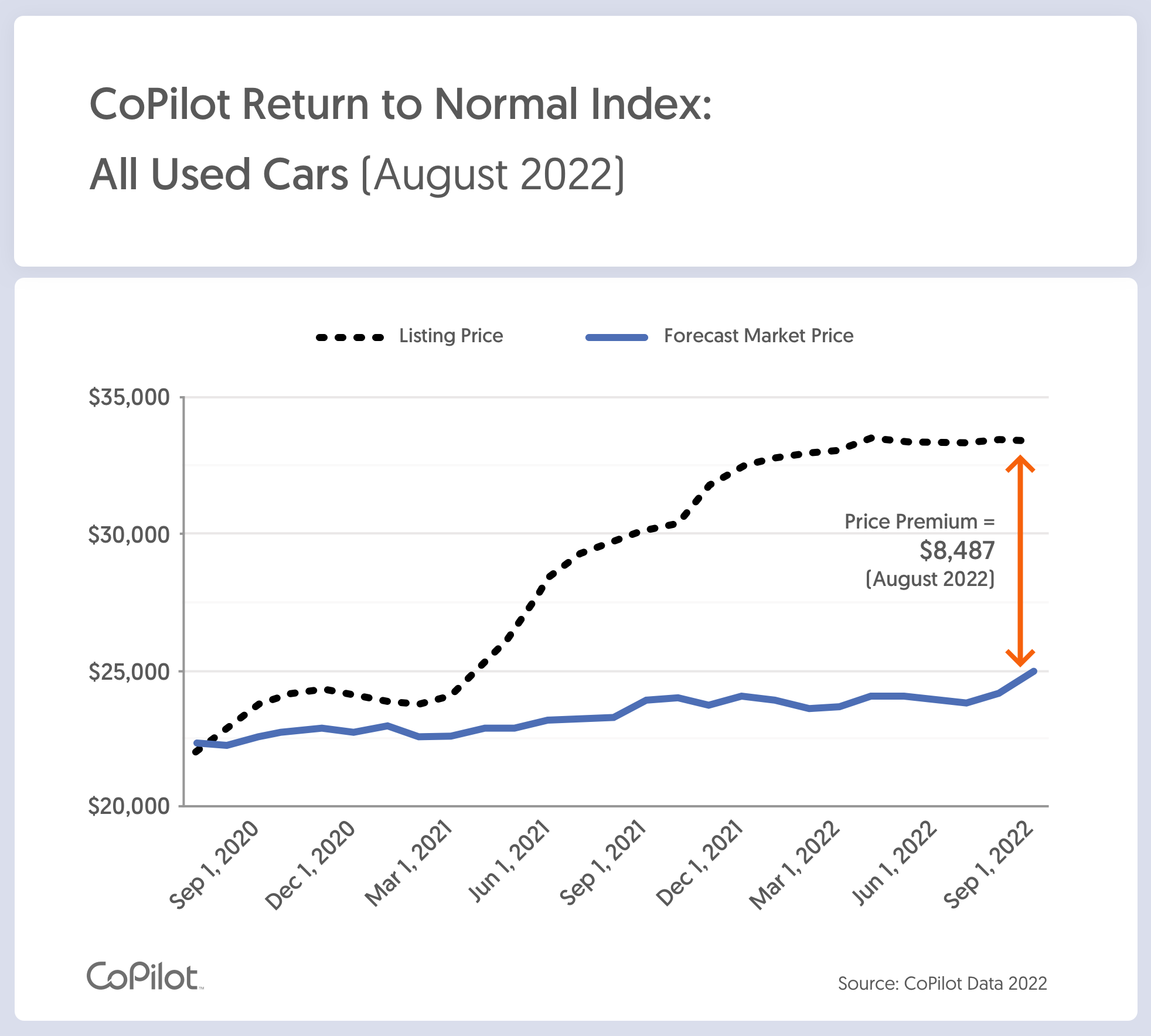

CoPilot’s Return to Normal Index shows the differential between what any used car price would have been today if not for the extraordinary dynamics of the past two years, versus how much it is actually worth now, at retail. As it tracks this differential over time, the Return to Normal Index provides the only real-time barometer of the used car market’s recovery, as well as how close individual vehicle segments, brands, and age brackets are to returning to normal pricing levels.

As of August 31, 2022, CoPilot’s Return to Normal Index found:

- Overall, used car listing prices averaged $33,414 in August, down $93 from the previous month

- August prices dropped in all age brackets. In particular, nearly-new (1-3 year old) car prices fell the most – by $715, or 1.7% – while increasing as a percentage of listings and sales.

- August used car price premiums averaged $8,497 (or 34%) above projected normal levels. This represents a staggering 9% decrease from last month’s index, which found that used car prices were $9,350, or 39%, above projected normal. This is the second consecutive monthly decline for the index, and by far the largest drop ever reported.

- This month’s index shows that, after prolonged price hikes over the two years, the used car market is finally showing signs of starting to return to normal levels.

- Reversing course from their dramatic run-up in price during the spring, electric and hybrid vehicles showed significant drops in average price and in Price Premiums.

- The story is evolving, but appears to be one of demand more than supply: Used car sales volume remains robust, but dealers have found they finally need to reduce prices to maintain the rapid sales rate of the last two years, in the face of rising interest rates and other economic headwinds.

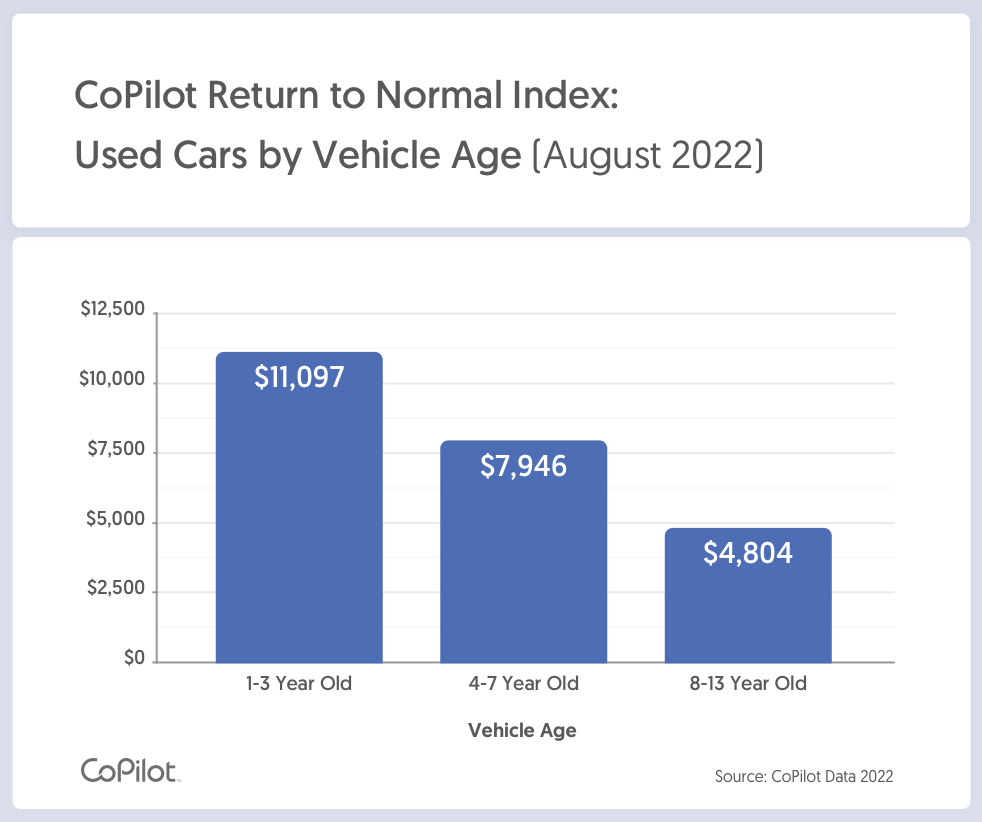

PRICE PREMIUM BY VEHICLE AGE

Within the overall market, newer used cars were the last to hit their peak, but have now dropped in price most quickly. Meanwhile, the listing price of older models, which has been falling for longer, dropped less significantly in August.

In August, nearly-new (1-3 year old) cars were listed at an average price of $41,545, representing a 2% decrease from July, a much steeper drop than last month, and a nearly $800 decrease since June’s peak.

- In August, the Price Premium for 1-3 year old cars was $11,097, or 36%, above projected normal levels – dropping in two months from the highest to the lowest among the three age brackets analyzed in the Return to Normal index report.

- This represents a 7% decrease from July, and 11% since June, when the Price Premium for this age bracket was 42% above projected normal levels. August was also the largest month-over-month Price Premium decrease in the history of the Index for these cars.

- Listing prices of pre-owned cars (4-7 years old) also declined in August. Their average price was $29,266, a decrease of $345 from July, and marking the fifth consecutive month of price drops for this age bracket.

- * The Price Premium for 4-7 year old cars in August was $7,946, or 37%, above projected normal levels.

- By comparison, in July, the Price Premium was $8,417, or 40%, above projected normal levels.

- Older used vehicle (8-13 years old) prices also trended downward in August. Their average listing price was $17,724, a $158 decrease from July and the fifth consecutive month of price decreases for this age bracket.

- * The Price Premium for 8-13 year old cars in August was $4,804, or 37%, above projected normal levels..

- By comparison, in July, the Price Premium for these vehicles was $5,002, or 39%.

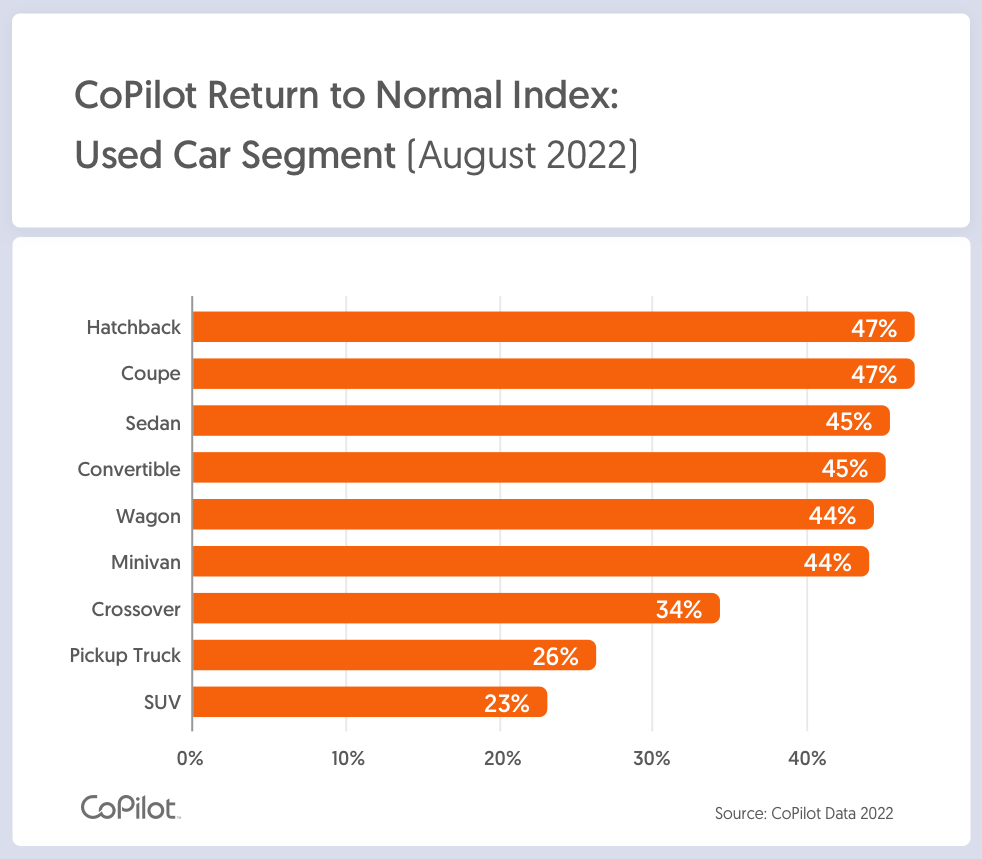

PRICE PREMIUM BY TYPE OF VEHICLE

As fuel prices continue their steady decline, this month marks a stabilization in prices for two gas-guzzling segments: used SUVs and pickup trucks.

In August, used SUVs showed an average listing price of $43,222, a $207 decline from last month’s prices.

- At $8,092, the Price Premium for used SUVs was a relatively modest 23% above normal expected prices – and a 10% drop since last month.

- By comparison, in July, the Price Premium for used SUVs was $8,981, or 26%, above projected normal.

- Used SUVs continue to have the smallest Price Premium by percentage of all vehicle segments, and thus are the segment relatively closest to returning to normal pricing levels.

In August, used pickup trucks were listed at an average price of $41,469, representing only a $89 decrease from last month, as pickup trucks continue to be comparatively less price-inflated than most other segments in the market.

- In August, used pickup trucks had the second-smallest Price Premium of all vehicle segments, at $8,638, or 26% above projected normal levels.

- This represents a 7%, or $646, decrease in their Price Premium since July, when used pickup truck prices were listed for $9,284, or 29%, above projected normal levels. August marks the second consecutive month in which the Price Premium for used pickup prices has declined.

PRICE PREMIUM BY FUEL TYPE

As gas prices continue to fall this summer, used electric vehicle prices continued to mirror this trend, falling 4% to an average of $64,306 in August.

- Used Tesla prices led this decline month-over-month, falling to $67,324 in August, a record 4% month-over-month decline.

- The Price Premium for used Teslas also fell in August, when they were listed at $20,251, or 43%, above projected normal levels.

- This represents a dramatic 11% decrease in the Price Premium for used Teslas in a single month. It is also the second consecutive month in which the Price Premium for used Teslas has declined, following a strong run-up in previous months; in June their prices peaked at over $71,000, reflecting a premium of $23,637, or 50%, above projected normal levels. This recent decline may reflect potential buyers choosing to wait for recently-announced tax incentives to go into effect for EVs, or making the switch from shopping for a used Tesla to a new one, or exploring other EV brands with more attractive tax credit eligibility.

For the second month in a row, used hybrid prices decreased in August as well. On average, used hybrids were listed at $47,790, a 3% decrease from July.

PRICE PREMIUM BY BRAND

Foreign brands continue to command higher price premiums than their domestic counterparts. This gap widened substantially in August, as domestic brands saw a significant 12% adjustment back towards normal price levels, while foreign brands marginally increased their price premium.

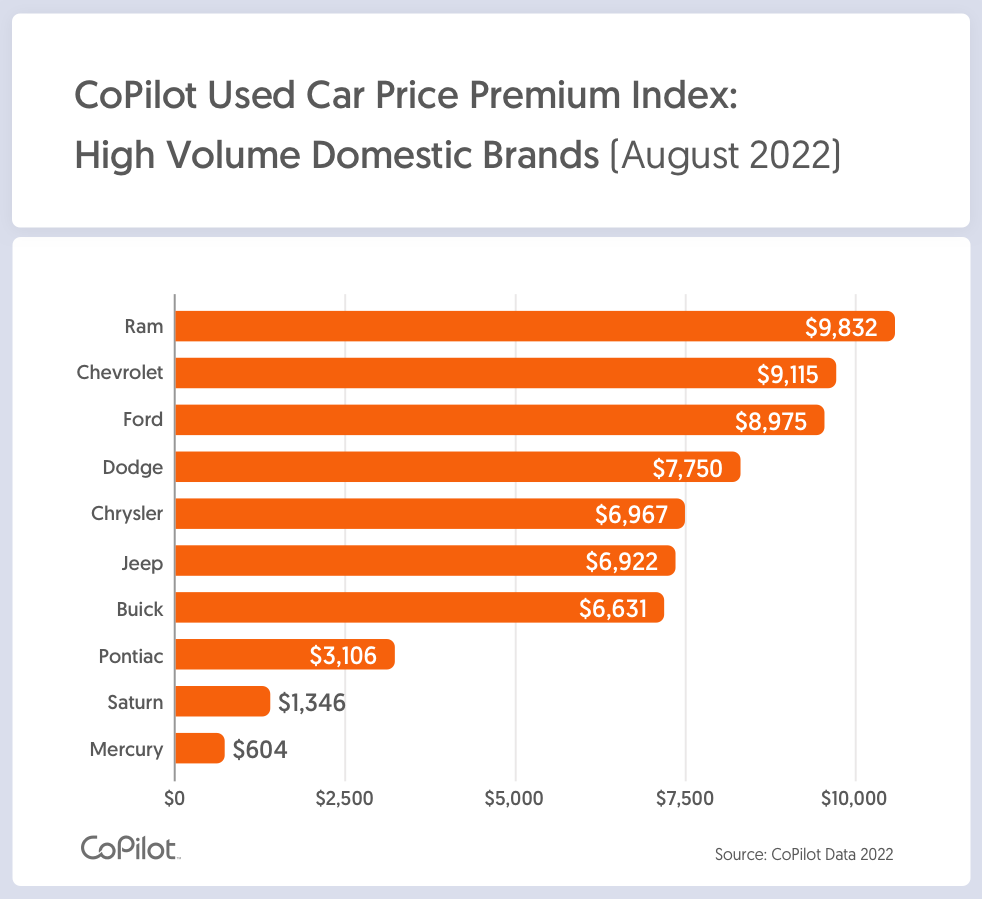

Domestic Brands:

In August, the Price Premium for high-volume domestic brands averaged $8,301, or 34%, above projected normal levels.

- This represents a significant 12% decrease from July, when the Price Premium for domestic brands was $9,454, or 40%, one of the most rapid shifts toward normal prices this month.

Used Ram vehicles had the highest absolute Price Premium among domestic brands, listed at $9,283, or 30%, above projected normal levels.

They were closely followed by used Chevrolets and Fords, listed at $9,115 and $8,975, respectively, above normal levels.

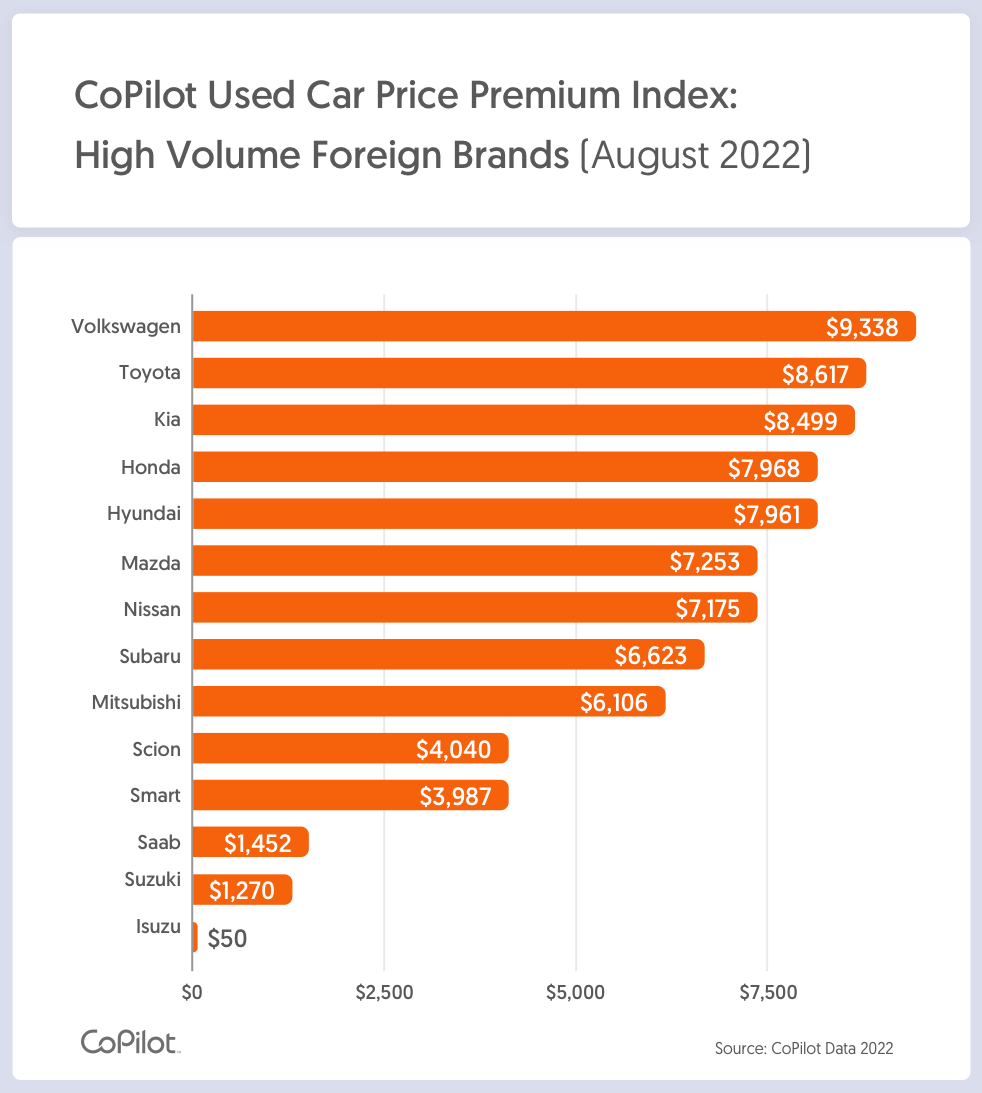

Foreign Brands:

In August, the Price Premium for high-volume foreign brands averaged $8,105, or 44%, above projected normal levels.

- In contrast to the sharp drop seen in domestic brands, this represents a slight increase from July, when the Price Premium for foreign brands was $8,012, or 44%, above projected normal levels.

Used Volkswagen vehicles once again had the highest absolute and relative Price Premium among foreign brands, listed at $9,338, or 57%, above projected normal levels.

Used Toyotas had the second-highest absolute Price Premium among foreign brands, listed at $8,617 (or 39%) above projected normal levels.

Hyundai and Kia each maintained a 53% Price Premium above their projected normal levels.

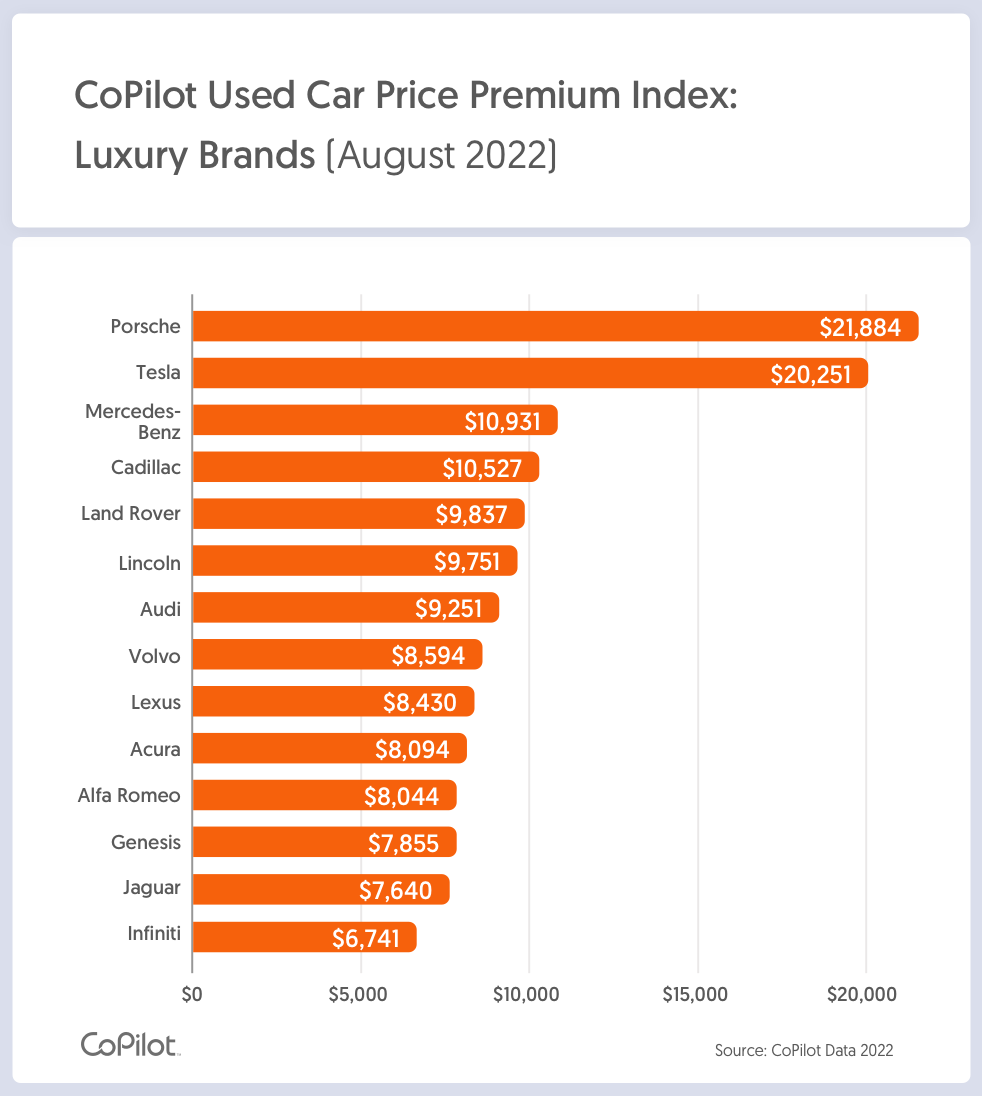

Luxury Brands:

In August, the Price Premium for luxury brands averaged $10,824, or 34%, above projected normal levels.

- This represents a slight decrease from July, when the Price Premium for luxury brands was $11,060, or 34%, above projected normal levels.

Used Porsches had the highest absolute Price Premium among luxury brands, listed at $21,884, or 35%, above projected normal levels.

Used Teslas had the second-highest Price Premium among luxury brands, listed at $20,251 or 43%, above projected normal levels. They were followed by used Mercedes Benz vehicles, which were listed at $10,931, or 30%, above projected normal levels.

ANALYSIS AND CONCLUSIONS

After two years of unprecedented used car price increases – caused by a confluence of factors, including the COVID-19 pandemic; supply chain disruptions; and rising inflation – the market finally appears to be cooling. Across the vast majority of age brackets, vehicle segments, and brands, prices are showing month-over-month declines, with some parts of the market now showing price declines for multiple consecutive months. Additionally, month-over-month, a number of vehicle types – including used SUVs and used Teslas – experienced double-digit percentage declines in their Price Premiums, showing that the market is reacting to changes in consumer demand, and that some vehicle classes are finally trending toward becoming more affordable for consumers.

For consumers in the market for a used car, long-anticipated relief may finally be on the horizon. Our advice to them is to monitor the market closely as prices continue to trend downward, and be prepared to make a move when the right car comes along, as we expect prices will continue to decline toward normal levels. For those with a used car to sell or trade in, however, now is the time to lock in the best price before market prices fall even more drastically.

Consumers can look up the real-time value and the Price Premium for any individual car they are looking to buy, or calculate the current trade-in value for their own car at www.copilotsearch.com/pricepulse

METHODOLOGY

The Return to Normal Index is drawn from data collected by leading car shopping app CoPilot. CoPilot’s data and proprietary methodology track the online inventory of virtually every dealer in the country, every day, offering real-time analysis around car prices, inventory, and sales. This September report covers data through August 31, 2022. Data and methodology have been refined in this report, for increased sensitivity to market fluctuations. Data may adjust in future, due to changes in methodology and as additional data sources are integrated.

CoPilot provides free pricing tools for consumers. Price Pulse makes it easy for car shoppers to check the current market value and Price Premium for any car, track price changes, and compare years and models to choose the right car and know when to buy. For car owners and sellers, Price Pulse calculates the real-time value of their car, using the same data only dealers used to have, allowing consumers to track how much their vehicle has appreciated, so they can decide whether and when to sell, or negotiate the best deal at trade-in or lease-end. For media publishers, CoPilot offers embeddable data tools, allowing journalists and bloggers to integrate interactive charts within their web content, apps, or newsletters, powered by CoPilot’s unique data and analytics.

Media Contact:

Kerry Close

732-609-2644

Popular Car Searches

Makes

Shop Used Cars

Used Volvo Convertible for Sale Near Me

Used Dodge Coupe for Sale Near Me

Used Lincoln Sedan for Sale Near Me

Used Honda Odyssey for Sale Near Cleveland, OH

Used BMW Wagon for Sale Near Me

Used Honda CR-V for Sale Near Huntsville, AL

Used Subaru Outback for Sale Near Minneapolis, MN

Used Nissan Murano for Sale Near Trenton, NJ

Used Ford Minivan for Sale Near Me

Used Lincoln Limousine for Sale Near Me

Used Honda Pilot for Sale Near Pompano Beach, FL

Used Mercedes-Benz Convertible for Sale Near Me

Used Honda HR-V for Sale Near Me

Used Subaru Wagon for Sale Near Me

Used Nissan Altima for Sale Near Fontana, CA

Used Toyota Camry for Sale Near Orlando, FL

Used Jeep Truck for Sale Near Me

Used Ford Transit Cargo Van for Sale Near Me

Used Ford Mustang for Sale Near Orlando, FL

Used Jaguar Convertible for Sale Near Me

Used Chrysler Suv for Sale Near Me

Used Toyota Coupe for Sale Near Me

Used Nissan Rogue for Sale Near Me