Used Car Market Finally Starts to Correct, But Prices Are Still a Long Way From Normal Levels

As new car inventory continues to replenish, pressure has further eased off used car prices – but they still remain significantly inflated above normal levels

Consumers should continue to wait to buy: Better bargains are likely to be had toward the end of the year

Electric vehicles are best value in the market, with used Teslas down another $1,800 last month

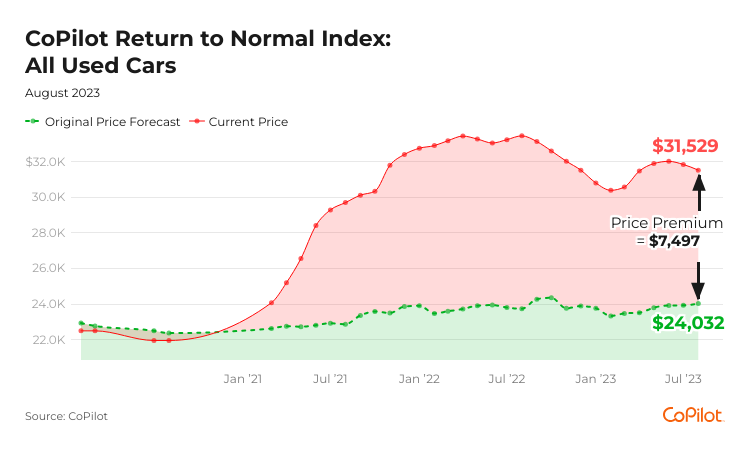

Chicago, IL – August 3, 2023 – Although used car prices saw some substantial drops in nominal terms in July, they are only starting to make their way back down toward normal levels, following a substantial spike in the market this spring, according to new data from leading car shopping app CoPilot. Though used car prices overall have dropped by nearly $500 in the past two months, and are down 6% since last summer, they are still at about the same pricing levels we saw in March, with an average price of $31,529, placing them $7,497 (or 31%) above projected normal levels, and still 6% above July 2021.

While the COVID-era inflation in the used car market finally started to ease in late 2022, this dip abruptly reversed course in the first half of 2023, as new car inventory continued to struggle with supply shortages and consumer spending remained surprisingly resilient. Between January and May 2023, used car prices jumped by 5%, before falling again in the summer as new car supply rebounded at last and consumers became increasingly bogged down by multiple interest rate hikes driving up the cost of cars in real terms. Since May, however, they have dropped only by about 2% (or $500). Therefore, while the market is starting to correct from the run-up in prices seen in the spring, there is significantly more room for prices to continue to fall.

“With used car prices finally easing this summer, many consumers may be asking themselves, ‘Should I buy the dip?’ The short answer is ‘No!’” said Pat Ryan, CoPilot CEO and Founder. “This is the start of a course correction for the used car market. So far, prices have only fallen to the levels they saw at the start of the year – but have yet to make up the very substantial gains they saw across the past three years of the pandemic, and they have a long way to go before approaching normal levels again. Consumers in the market for a used car therefore should wait: In the next few quarters, there will almost certainly be better bargains to be had.”

This phenomenon can especially be seen in the most expensive parts of the market, which saw the largest increases in the spring. For instance, 1-3 year old (nearly-new) car prices had increased by $1,700 (or 4%) between January to April. Since peaking in the spring however, they’ve fallen by $1,693 (or 4%) – almost back to the levels at which they started the year. Similarly, used SUV prices had jumped by $3,302 (or 8%) between January and May. Since reaching their peak, they’ve fallen by just $561 (or 1%) – indicating that while they are starting their journey back to normal pricing, they still have much further to fall.

“The used car market has remained surprisingly resilient,” Ryan added. “That’s in large part because the market underestimated the strength of the consumer and how long it would take for them to finally burn off their excess pandemic-era savings. While this led to a surprising resurgence in used car prices in the spring, over time, the impact of multiple interest rate hikes, combined with new inventory finally replenishing, have finally started to put a damper on consumer appetite for used cars. But the market has only just started to correct: Used cars, typically a deflationary asset, are still priced more than 30% above where we would ordinarily expect them to be.”

Though consumers are better off waiting to buy across the vast majority of segments in the used car market, used electric vehicles are the rare exception, remaining one of the strongest buys in the used car market in 2023. In the past month, used EV prices have fallen by another $1,200 (or 3%) to an average of $42,891, a massive $24,500 or 36% below their gas-price driven peak in July 2022. Dominating this segment are used Teslas – still feeling the ripple effects of price cuts to new models since December 2022 – fell by another $1,800 (or 4%) in July alone, to an average of $43,624 (39% below last summer’s peak of $71,100). Consumers have been taking advantage of these price declines, with used Tesla sales volume seeing an 8% spike in July and used EV sales overall jumping by 11%.

About CoPilot

CoPilot is a leading car buying app that provides consumers with an expert partner for high-consideration purchases, starting with car buying and ownership. The platform combines massive real-time data with a winning combination of human expertise and AI-powered search to introduce transparency to the shopping, purchasing and ownership journey. The mobile application takes the time, frustration, and guesswork out of the process, empowering people to easily navigate the risks of shopping for high-value items, and to buy with confidence at the right price and the right time.

CoPilot provides free AI-powered search and pricing tools for consumers. CoPilot’s

AI-powered Model Discovery Tool provides car comparisons and model recommendations, serving as an intelligent agent to make AI actionable for car shoppers. The tool applies CoPilot’s proprietary analytics to the company’s comprehensive listings database, in order to save time, money, and frustration for car shoppers. The user-friendly chat interface delivers AI-powered analysis to recommend and rank the best cars that meet each shopper’s specific needs within their chosen geographic area. Additionally, CoPilot’s ChatGPT plugin is the first to rank and return real-time listings within ChatGPT’s chat interface.

CoPilot’s pricing tool, Price Pulse, makes it easy for car shoppers to check the current market value and Price Premium for any car, helping them to know what and when to buy, sell or trade-in, using the same data only dealers used to have.

For media publishers, CoPilot offers free, embeddable data tools, including Price Pulse market trends, allowing journalists and bloggers to integrate interactive charts and tables within their web content, apps, or newsletters, powered by CoPilot’s unique data and analytics. Follow CoPilot on Twitter here for original data and insights.

View this month’s Index Report findings here.

Media Contact:

Kerry Close

732-609-2644

Popular Car Searches

Makes

Shop Used Cars

Used BMW Sedan for Sale Near Me

Used Subaru Outback for Sale Near Nashua, NH

Used Subaru Outback for Sale Near Thornton, CO

Used Honda for Sale Near Me

Used Subaru Outback for Sale Near Norwich, CT

Used Nissan Murano for Sale Near Me

Used Audi Hatchback for Sale Near Me

Used Toyota Camry for Sale Near Fort Lauderdale, FL

Used Honda Suv for Sale Near Me

Used GMC Van for Sale Near Me

Used Ford Fusion for Sale Near New Orleans, LA

Used Toyota Van for Sale Near Me

Used Lexus Coupe for Sale Near Me

Used Volkswagen Minivan for Sale Near Me

Used Honda Civic Sedan for Sale Near Pompano Beach, FL

Used Smart Convertible for Sale Near Me

Used Subaru Outback for Sale Near Salt Lake City, UT

Used Nissan Hatchback for Sale Near Me

Used Honda CR-V for Sale Near Bellevue, WA

Used Ford Transit Van for Sale Near Me

Used Volvo Wagon for Sale Near Me

Used Ford Explorer for Sale Near Salem, OR

Used Mazda Minivan for Sale Near Me