CoPilot’s Return to Normal Index

August 3, 2022 Report

EXECUTIVE SUMMARY: JULY 2022 DATA

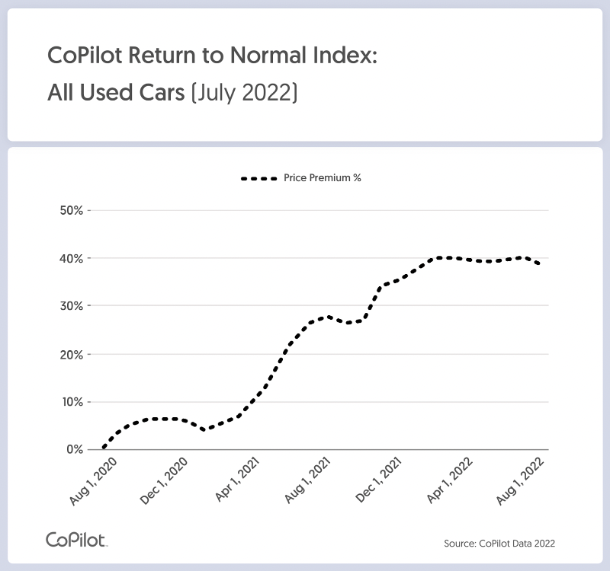

CoPilot’s Return to Normal Index shows the differential between what any used car would have been worth today if not for the extraordinary dynamics of the past two years, versus how much it is actually worth now, at retail. As it tracks this differential over time, the Return to Normal Index provides the only real-time barometer of the used car market’s recovery, as well as how close individual vehicle segments, brands, and age brackets are to returning to normal pricing levels.

As of July 31, 2022, CoPilot’s Return to Normal Index found:

- Overall used car listing prices were $33,551, an increase compared to June, due to higher-priced, recent model year vehicles making up a bigger proportion of dealer inventories and driving up the average.

- Used car prices averaged $9,384, or 39%, above projected normal levels for similar cars – the first decrease in CoPilot’s Return to Normal index for three months.

- Despite multiple interest rate hikes, totalling 200 basis points in the last three months, the used car market overall continues to hold surprisingly firm.

- There are a number of signs of softening beginning to show in multiple vehicle segments and age brackets.

- As gas prices fell in July, hybrid and electric vehicle prices also declined for the first time in months, while, conversely, SUV and pickup truck prices rebounded.

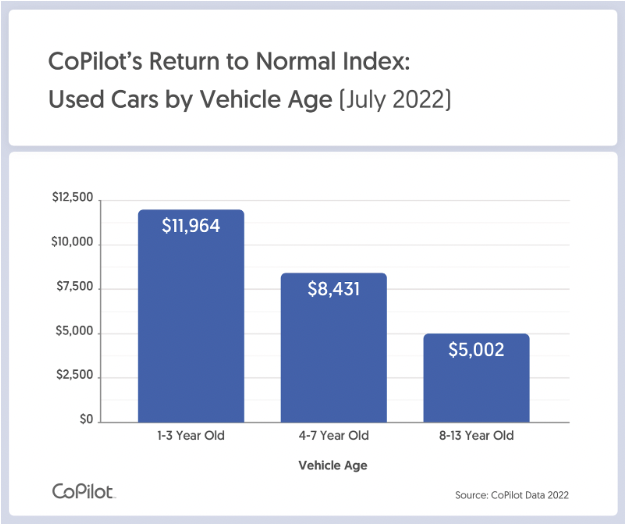

PRICE PREMIUM BY VEHICLE AGE

In July, nearly-new (1-3 year old) cars were listed at an average price of $42,276, representing a less than 1% decrease from last month.

- In July, the Price Premium for 1-3 year old cars was $11,964, or 40%, above projected normal levels.

- This represents a decrease from June, when the Price Premium for this age bracket was 42% above projected normal levels.

Similarly, pre-owned cars (4-7 years old) fell slightly in July. The listing price of 4-7 year old vehicles was $29,628, a decrease of $186 from their June prices.

- The Price Premium for 4-7 year old cars in July was $8,431, or 40%, above projected normal levels.

- By comparison, in June, the Price Premium was $8,810, or 42%, above projected normal levels.

Older used vehicle (8-13 years old) prices also declined in July. Their average listing price was $17,878, down $187 from June and continuing a four-month downward trend.

- The Price Premium for 8-13 year old cars in July was $5,002, still 39% above projected normals.

- By comparison, in June, the Price Premium for these vehicles was $5,313, or 42%, above projected normal levels.

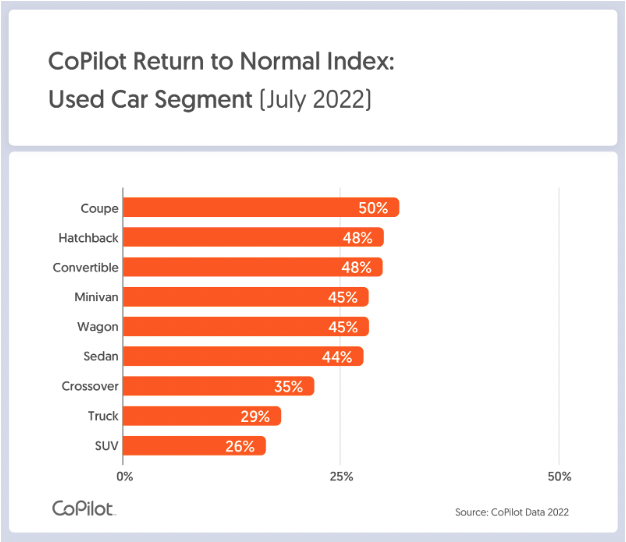

PRICE PREMIUM BY TYPE OF VEHICLE

In July, prices of used SUVs showed an average listing price of $43,482. As gas prices ticked downward, this gas-guzzling segment saw a slight increase in price from their June average of $43,342, reversing recent trends.

- At $9,015, the Price Premium for used SUVs was 26% above normal expected prices.

- By comparison, in June, the Price Premium for used SUVs was $9,273, or 27%, above projected normal – the fourth consecutive month that its Price Premium had decreased.

- In July, used SUVs had the smallest Price Premium of all vehicle segments, showing they remain the segment relatively closest to returning to normal.

Used pickup truck prices have shown less price volatility than most other vehicle types. In July, they were listed at an average price of $41,591, a $92 increase from June, potentially reflecting the drop in gas prices.

- In July, used pickup trucks had the second-smallest Price Premium of all vehicle segments, at $9,320, or 29% above projected normal levels.

- This represents a slight decrease in their Price Premium from June, when used pickup truck prices were listed for $9,735, or 31%, above projected normal levels.

- With an all-time high Price Premium of 31% in April, this is the third consecutive month in which the Price Premium for used pickup prices has declined, making them relatively better value than less discretionary segments.

PRICE PREMIUM BY FUEL TYPE

With gas prices falling somewhat in July, the average price of used electric vehicles also declined slightly to $66,986. This represents a $295 decrease from June prices, and the first month-over-month decline in 6 months.

- Used Tesla prices – often used as a proxy for the EV market – also declined slightly, for the first time in over a year, easing to $70,279, a $718 decrease since June.

- Correspondingly, the Price Premium for used Teslas fell: In July, used Teslas were listed at $22,741, or 48%, above projected normal levels. This represents a minor price softening since June, when used Teslas were priced $23,628, or 50%, above projected normal levels, and still the highest percentage premium among luxury brands.

Potentially reflecting the same drop in gas prices, used hybrid prices also saw a minor decrease in July. On average, used hybrids were listed at $49,335, a $289 decrease from June.

PRICE PREMIUM BY BRAND

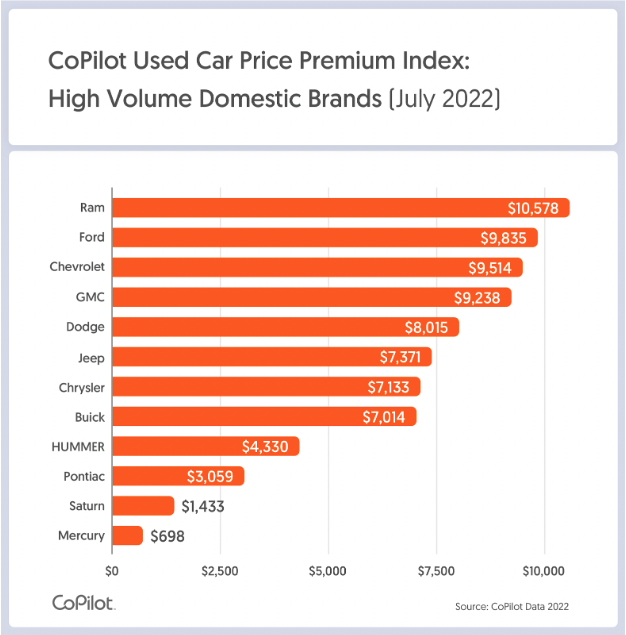

Domestic Brands:

In July, the Price Premium for high-volume domestic brands averaged $9,490, or 40%, above projected normal levels.

- This represents a slight decrease from June, when the Price Premium for domestic brands was $9,599, or 41%, above projected normal levels.

Used Ram vehicles had the highest absolute Price Premium among domestic brands, listed at $10,758, or 32%, above projected normal levels.

Used Fords had the second-highest Price Premium among domestic brands, listed at $9,835 above projected normal levels. They were closely followed by used Chevrolets and GMCs, listed at $9,514 and $9,238, respectively, above normal levels.

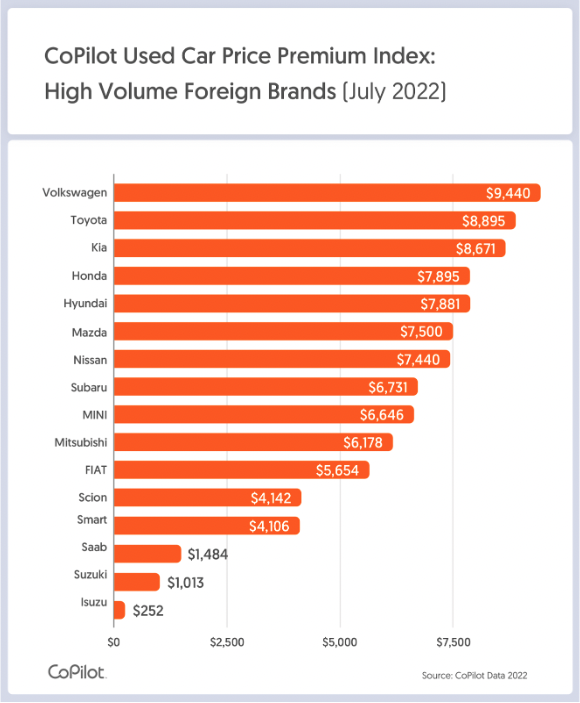

Foreign Brands:

In July, the Price Premium for high-volume foreign brands averaged $8,034, or 44%, above projected normal levels.

- This represents a slight increase from June, when the Price Premium for foreign brands was $7,940, or 44%, above projected normal levels.

Used Volkswagens again had the highest Price Premium among foreign brands, listed at $9,440, or 58%, above projected normal levels.

Used Toyotas and Kias had the next-highest Price Premiums among foreign brands, listed at $8,895 and $8,671, respectively, above projected normal levels.

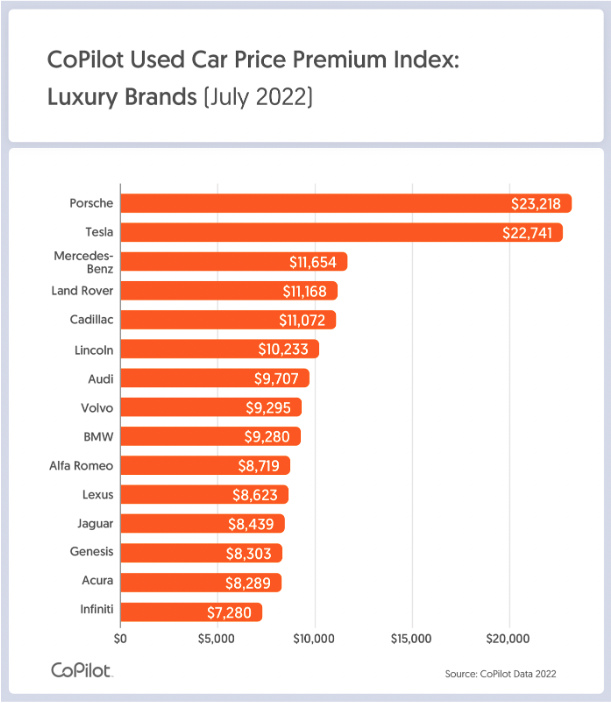

Luxury Brands:

In July, the Price Premium for luxury car brands averaged $11,093, or 34%, above projected normal levels.

- This represents a small decrease from June, when the Price Premium for luxury brands was $11,378, or 36%, above projected normal levels.

Used Porsches had the highest Price Premium in dollar terms among luxury brands, listed at $23,218, or 37%, above projected normal levels.

Their Price Premium was closely followed by that of used Teslas, which in July were listed at $22,741, or a category-leading 48%, above projected normal levels.

ANALYSIS AND CONCLUSIONS

Perhaps surprisingly, amid ongoing economic headwinds (particularly the Federal Reserve’s three major interest rate hikes, amounting to a 2% increase over the past three months), consumers are still faced with an intensely competitive used car market. With new and used car inventory hovering near historic lows, and prices still near all-time highs, it remains one of the most expensive times in history to buy a used car, with most vehicle types still commanding a 30-40% premium or more, compared to normal prices.

However, there are early signs of pressure easing, with prices and premiums starting to drop in multiple segments. SUVs and pickup trucks are the closest to normal pricing, and may continue this trend as long as gas prices remain high. Used electric and hybrid vehicles – which surged to record prices in the spring as prices at the pump also skyrocketed – saw modest softening in July as gas prices also started to ease off.

Savvy consumers should be monitoring the market as prices change, comparing makes and models to find the best value, and be prepared to make a move when prices eventually trend closer toward normal.

For those with a used car to sell, now is the time to lock in an optimal price before the used car market starts to fall off more significantly. Consumers with trade-in to offer a dealer may be best placed to negotiate a good deal, if they can’t wait to buy their next car.

Consumers can look up the real-time value and the Price Premium for any individual car they are looking to buy, or calculate the current trade-in value for their own car at www.copilotsearch.com/pricepulse.

METHODOLOGY

The Return to Normal Index is drawn from data collected by leading car shopping app CoPilot. CoPilot’s data and proprietary methodology track the online inventory of virtually every dealer in the country, every day, offering real-time analysis around car prices, inventory, and sales. This August report covers data through July 31, 2022. Data and methodology have been refined in this report, for increased sensitivity to market fluctuations. Data may adjust in future, due to changes in methodology and as additional data sources are integrated.

CoPilot provides free pricing tools for consumers. Price Pulse makes it easy for car shoppers to check the current market value and Price Premium for any car, track price changes, and compare years and models to choose the right car and know when to buy. For car owners and sellers, Price Pulse calculates the real-time value of their car, using the same data only dealers used to have, allowing consumers to track how much their vehicle has appreciated, so they can decide whether and when to sell, or negotiate the best deal at trade-in or lease-end. For media publishers, CoPilot offers embeddable data tools, allowing journalists and bloggers to integrate interactive charts within their web content, apps, or newsletters, powered by CoPilot’s unique data and analytics.

Media Contact:

Kerry Close

732-609-2644

Popular Car Searches

Makes

Shop Used Cars

Used Subaru Outback for Sale Near Salt Lake City, UT

Used Ford Mustang for Sale Near Sandy Springs, GA

Used Nissan Rogue for Sale Near Orlando, FL

Used Nissan Armada for Sale Near Mission Viejo, CA

Used Audi Sedan for Sale Near Me

Used Subaru Outback for Sale Near Nashua, NH

Used Honda Civic Sedan for Sale Near Lowell, MA

Used Nissan Titan for Sale Near Mission Viejo, CA

Used Nissan 370Z for Sale Near Atlanta, GA

Used Subaru Outback for Sale Near Colorado Springs, CO

Used Honda Civic Sedan for Sale Near Pompano Beach, FL

Used Mitsubishi Truck for Sale Near Me

Used BMW Roadster for Sale Near Me

Used Toyota Convertible for Sale Near Me

Used Land Rover Suv for Sale Near Me

Used Mazda Wagon for Sale Near Me

Used Volvo Suv for Sale Near Me

Used Alfa Romeo Sedan for Sale Near Me

Used Lincoln Truck for Sale Near Me

Used BMW Coupe for Sale Near Me

Used Ford Fiesta for Sale Near Houston, TX

Used Nissan Rogue for Sale Near Burbank, CA

Used Infiniti Convertible for Sale Near Me