EV Wreckage: Tesla Struggles Expose Broader EV Challenges

Traditional automakers face the reality of the technology adoption curve, overproducing EVs significantly relative to consumer demand

Customers will benefit as EV prices plummet

INTRODUCTION

Recent layoffs and slumping sales at Tesla – the clear frontrunner in the electric vehicle market – have put a spotlight on the broader struggles facing the EV market. EV adoption has hit an undeniable roadblock, driven by one key factor: Automakers fundamentally misunderstood the technology adoption curve. As a result, they have significantly overproduced EVs relative to consumer demand.

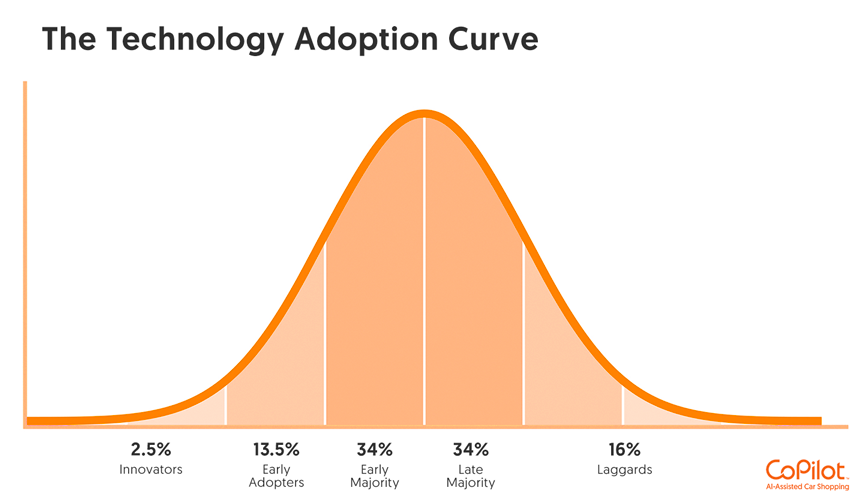

The technology adoption curve is a bell curve model that indicates that so-called “early adopters” – who are more risk-prone individuals, with higher levels of disposable income, and with an innate curiosity around new innovations – will be the first to invest in a new technology. These individuals comprise a very small proportion of the total number of people who could conceivably, eventually buy this new technology. According to the bell curve model, in the early adoption phase, initial adoption of a new technology will be relatively slow, and will only start to increase as the technology gains traction among more mainstream consumers (who are more budget-conscious and more likely to object to logistical challenges with a new technology).

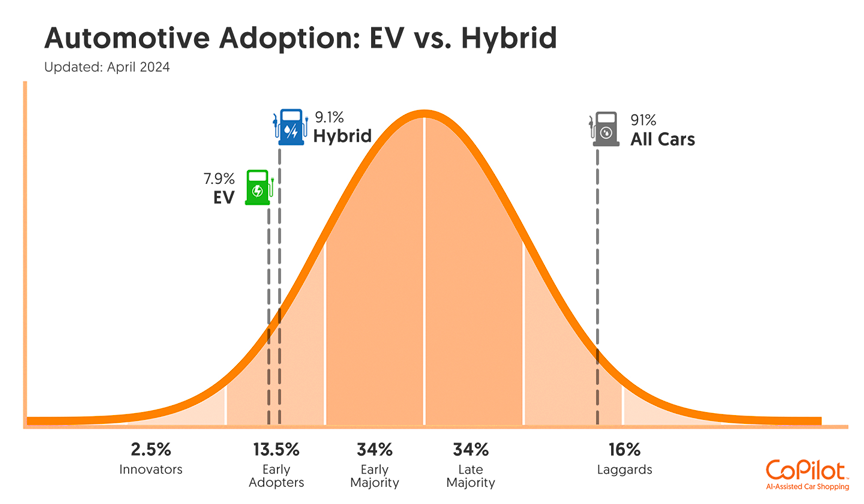

Currently, EVs are solidly positioned in the early adoption phase: They represent just 7.9% of the total 15.¹ million vehicles sold in the U.S. last year¹. But as traditional automakers moved into the EV market, responding to government electrification pushes and the initial success of Tesla, they failed to take into account the technology adoption curve. As a result, they made a big, but flawed, bet on EVs, ramping up production volume too quickly, erroneously assuming that EVs had reached mainstream consumer adoption. This has led to the current glut in EV supply, since there are not yet enough mainstream consumers willing to take the plunge on buying an EV to meet the level of supply that’s currently in the market.

Tesla, the EV market leader, was able to sidestep these pitfalls for a long time, in large part due to its strategy of focusing its initial entry to the market on the luxury vehicle sector (through the Roadster, Model S, and Model X). By nature, luxury car buyers are more likely to be early adopters, with greater levels of disposable income and a higher tolerance for risk. Over time, as the first mover in the EV market, Tesla also developed production efficiencies and economies of scale that allowed it to outkick its competitors, even after it started making price cuts. But now, as Tesla has saturated the early adopter market – and does not have an EV that is priced at a level that would appeal to more mainstream buyers – it too is suffering from the same challenges as the rest of the EV market, with slowing sales and declining profitability.

In the short term, EV manufacturers’ struggles will benefit two parties in particular:

- Automakers, like Toyota, that bet early and big on hybrids: Hybrid sales are skyrocketing as they offer consumers many of the benefits of EVs, without the logistical challenges around charging infrastructure and time

- Consumers, who are already seeing significant drops in new and used EV prices as inventory builds, and will continue to benefit as automakers are incentivized to produce more affordable EVs

In the long term, the auto industry’s miscalculation around the technology adoption curve will result in a fundamental reset. Previously, car manufacturers were locked in a race to 100% electrification. Now, they find themselves scaling back significantly on their EV plans in the short-term in order to maintain hope of long-term viability.

THE ROLE OF THE TECHNOLOGY ADOPTION CURVE

The technology adoption is a bell curve model that describes how different people react to, accept, and ultimately adopt new technology. It has five phases:

- Innovators (2.5%): The first group to adopt EVs. This group is the most open to risk, the most technically curious, and are not only open to trying new technology, but also have the means to do so. This is a crucial component to the electric vehicle story: With an average listing price of $64,146, new EVs cost 44% more than their gas-powered counterparts.

- Early adopters (13.5%): This category represents the most influential opinion leaders, who can influence the decision-making of others. Similar to innovators, they are curious and eager to try new technology, and have the financial means to do so.

- Early majority (34%): This group is more practical and measured in their decision-making, but will eventually follow the innovators and early adopters in adopting EVs.

- Late majority (34%): This group is more risk-averse and cautious. They will likely not adopt EVs until they have achieved a strong degree of popularity and are more accessible from a cost and infrastructure perspective.

- Laggards (16%): This group will be the last to adopt EVs, and will likely require significant incentives in order to do so.

Furthermore, this technology adoption curve represents the conceivable universe of individuals who at some point could be convinced to buy an EV – rather than the entire U.S. population. There will inevitably remain a sizable portion of the population who will always choose a gas-powered vehicle for any number of reasons, including ease of refueling and personal preferences – factors that this report will explore in more detail.

Because EVs have yet to reach the early majority, sales growth is starting to slow: While North American EV sales increased by 54% in 2023, this is expected to fall to 32% in 2024². At the same time, EVs are starting to pile up on dealer lots: CoPilot data shows that market days supply of new EVs (or available inventory on dealer lots) has risen by 21% in the past year, and EVs on average take almost a month longer for dealers to move off their lots than gas-powered cars. This is a direct result of where EVs fall on the technology adoption curve: Growth is slowing as it becomes increasingly difficult to convince the majority of consumers to grapple with issues like charging infrastructure, range anxiety, cost, and trust in a new technology.

At the same time, the automotive industry placed a major, and ultimately flawed, bet on EVs. Faced with insufficient demand to buy the EVs they have already produced, a number of automakers, including Ford, GM, Volkswagen and Mercedes-Benz, have scaled back or delayed further EV production plans.³ Similarly, in January 2024, Hertz said it would sell 20,000 EVs (of its 50,000 EV fleet) throughout the year and replace them with gas-powered cars, citing low consumer demand and high repair costs as the driving factors⁴. This miscalculation led to the resignation of its CEO just months later⁵ – and is just one example among others in the auto industry of the impacts of misjudging consumer appetite for EVs.

ELECTRIC VEHICLE CONSUMER PAIN POINTS

While there are undeniably pain points, EVs have a number of factors that pulled consumers in in the first place, including:

- Environmental reasons: Especially for early adopters, many EV purchases were spurred by a desire to drive a more eco-friendly vehicle, as EVs do not burn gas and are able to operate in a more energy-efficient manner. Relatedly, many of these early adopters looked to virtue-signal to others in their community by making an EV purchase.

- Fuel cost volatility: The price of EVs surged in the spring of 2022, when the war in Ukraine sent fuel costs skyrocketing and many consumers looking for a more cost-effective alternative. Generally speaking, the price of fuel can see-saw dramatically, and EVs are attractive to consumers who are looking to eliminate that variability in their budget.

- Tax incentives: A number of EVs (though not all EVs) qualify for a $7,500 tax credit for buying an EV. However, according to CoPilot data, the average price of a new EV is 41% more expensive than a gas-powered car – and the tax credit is often not enough to offset that.

Despite these advantages, however, there are a number of pain points that limit the practical universe of potential EV buyers, including range anxiety, charging infrastructure, and personal preference (since some individuals inevitably will prefer hybrids and gas-powered cars to EVs, and may never buy an EV).

Charging

While most EV charging takes place at home, this also poses an issue for many. Thirty-seven percent of all households lack a garage or carport, which is essential to having the ability to charge an EV. For those who rent (about 36% of the country), the majority of rental units (63%) lack a garage or carport⁶.

Charging infrastructure is one of the most significant drawbacks for consumers considering an EV purchase. According to a June 2023 study by Cox Automotive, 32% of consumers thinking about buying an EV said a “lack of charging stations in my area” was a major barrier to their purchase⁷. In fact, six of the top 10 car markets were cities on the West Coast, and the top four were metropolitan areas in California, per data from S&P Global Mobility. Furthermore, even where chargers are available, they often aren’t fully functional: A JD Power study in 2023 found that 20.8% of EV drivers using public charging stations experienced charging failures or equipment malfunctions that caused them to be unable to charge their vehicles⁸. This is particularly exacerbated in cold weather, which not only negatively impacts an EV’s range, but also its charging ability.

Range Anxiety

The notable reality about range anxiety is that it actually is not a serious issue for most people, most of the time. Eighty-percent of all passenger vehicle journeys are commutes of 12 miles or less, while 60% are six miles or less⁹. A whopping 96% are 62 miles or less. However, while people don’t need to worry about charging, they still need the same car for short and long-term journeys – creating a challenge for EVs, but an opportunity for hybrids, which can serve both purposes. Moreover, for those long-range journeys, Consumer Reports found that half of the EVs they tested in April 2023 fell short of their range estimates¹⁰. Temperature is one factor that can have a significant impact on EV range: for instance, on very cold days, EVs’ range can be reduced by as much as 50%.¹¹

Cost

In addition to having a higher sticker price than gas-powered cars, EVs also come with heftier repair costs, at $6,787 per collision compared to $4,420 for all other cars¹². Their parts can be very expensive to replace out of warranty; they are often more difficult to find and there is a shortage of mechanics trained to fix EVs. As a result, often batteries are replaced rather than repaired, causing insurers to total EVs that may have only experienced minor damage¹³. In turn, this drives up insurance costs for drivers. These added costs serve as a significant deterrent for consumers outside of the innovator and early adopter phase, who do not have the same level of enthusiasm and interest, nor the financial resources, to invest early in EVs.

TESLA’S CURRENT STRUGGLES

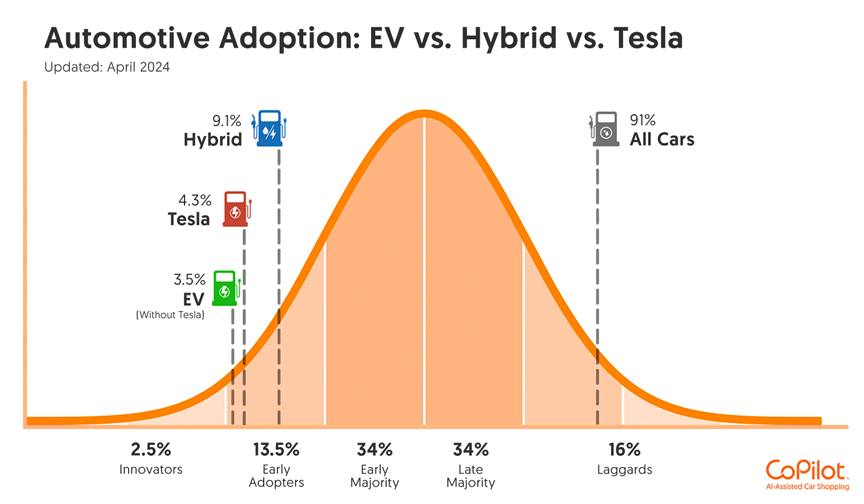

Tesla is the clear market leader in the EV space, making up 56.5% of U.S. EV sales.¹⁴ One major issue for traditional manufacturers is that they lack the early mover advantage that Tesla has in terms of production efficiencies and economies of scale: They are unable to make EVs profitably and keep up with Tesla’s consistent price cuts. Additionally, Tesla’s early success caused them to overlook or make serious miscalculations around the technology adoption curve. Assuming they could replicate Tesla’s strong sales, they significantly overproduced. EV startups face even more of an uphill battle: For instance, Rivian and Lucid are aiming to produce roughly the same amount of vehicles as last year (57,000 and 9,000, respectively), indicating stagnant demand.

Despite these challenges, some traditional automakers – including luxury brands like BMW – are starting to catch up. Others are exploring creative solutions to try to gain back ground: for instance, Honda and Nissan, which recently signed a memorandum of understanding to explore a potential partnership.¹⁵ However, they nonetheless face an uphill battle in gaining interest from consumers. According to CoPilot data, without Tesla, EVs would make up only 3% of total market share for new cars, a striking indication of how far this segment still has to go in order to move toward more mainstream adoption.

But Tesla – which recently laid off 10% of its workforce and whose share prices have dropped by 40% alone this year¹⁶ – is also not immune to the broader challenges facing EVs. In order to understand why Tesla too is struggling, it’s helpful to look at its unique approach to entering the EV market. The company’s initial success was driven by its segment-by-segment approach to entering the market. In contrast to traditional automakers’ EV strategies, Tesla started by focusing on the luxury market, first with the release of the Roadster (whose prices started at $200,000). The luxury market is a natural fit for early EV adopters: Its customer base has more people with disposable income, who are more inclined to take risks, more likely to own a second car (given the majority of EV owners also own another car), and have a garage to charge their EV. After the Roadster, Tesla’s subsequent expansion also continued within the luxury market, delving into the luxury sedan market with the release of the Model S in 2012 and the luxury crossover market with the release of the Model X in 2016. In fact, until the mid-size Model 3 became mainstream, Tesla focused almost exclusively on the luxury market, allowing it to more quickly gain market share among consumers who were more likely to be inclined to buy an EV.

Its approach contrasts that with that of traditional automakers that were early entrants to the EV market, like Chevrolet and Nissan with the Bolt and Leaf, respectively. The Bolt and the Leaf, both smaller vehicles in a more affordable price bracket, saw slow sales in the wake of their release, in large part because Chevrolet and Nissan also misunderstood the adoption curve. By failing to target the types of customers who were more likely to be innovators and early adopters, Chevrolet and Nissan quickly fell far behind Tesla in terms of market share.

This luxury-first approach has allowed Tesla to stave off the pain for some time, but it is now facing the same challenges that are plaguing the rest of the EV market. Tesla has saturated the market for early adopters, and does not have an affordable model that could tempt mainstream consumers to overlook issues like charging logistics. Even the Model 3, at a starting price of $38,990, is priced significantly above most gas-powered compact car alternatives.

Consequently, starting in the spring of 2023, hybrid sales began to slowly outpace Tesla’s, even despite Tesla’s multiple price cuts. The issues are only becoming progressively worse: In Q4 2024, after seeing a 8.5% decline in worldwide sales, Tesla has undertaken more aggressive price cuts (it has cut prices on the Model Y, for instance, by as much as $5,000).¹⁷

THE RISE OF HYBRIDS

The challenges facing Tesla and EVs as a whole have presented a major opportunity for hybrids, which have emerged for many consumers as a more palatable alternative to EVs. Especially in comparison to Teslas and other EVs, hybrid sales are on the rise: CoPilot’s data shows that while EV sales fell by 8% in the past six months, hybrid sales increased by 8%.

Hybrids present many of the advantages of EVs, without many of the downsides. They can function as fully electric for 20 to 40 miles at a time¹⁸; their average sticker price is lower than that of EVs (and many plug-ins qualify for the same tax breaks and incentives as EVs); and they have been available in the market for over two decades, giving consumers more time to become comfortable with the technology.

Consequently, while EV inventory has skyrocketed over the past year, availability of hybrids on dealer lots has grown more modestly. In fact, hybrids, currently at 58 market days supply, are currently in less supply than gas-powered vehicles, and its sales are outpacing those of gas-powered cars. For manufacturers like Toyota who have long invested in hybrids and argued that the path to full electrification will be long, this has proven to be a smart business strategy: Toyota was the top-selling automaker of 2023, and attributed much of this growth to success in its hybrid business¹⁹. In fact, year-over-year, Toyota’s hybrid sales jumped by a staggering 85%, according to CoPilot data. Consequently, other brands like GM – that had initially invested heavily in EVs – are pivoting to focus more on the production of plug-in hybrids²⁰.

The hybrid story is not entirely positive: they are still relatively expensive, priced just 10% less than new EVs, at an average of. Their environmental benefits are also not entirely assured: A 2022 analysis by the International Council for Clean Transportation found that real-world electric drive share in plug-in hybrids may be anywhere between 26-56% lower than EPA estimates, while real-world fuel consumption may be 42-67% higher.²¹ As a result, and also due to government pushes for full electrification, next decade, EV growth over the next decade is still expected to outpace that of hybrids. But in the short term, hybrids are proving to be more of a bridge technology than the auto industry initially expected, and for Toyota, their early bet on hybrids is paying off in the short term.

CONSUMER IMPACT

EV adoption is not so much on the decline as it is stalled. EVs find themselves at an important inflection point: Until some of the most significant consumer pain points (including charging, infrastructure, and cost) are eased, EV growth will continue at a much slower rate in 2024 and likely in subsequent years as well. At its core, this is purely a function of where EVs fall on the technology adoption curve – still before the point where most mainstream consumers would be convinced to make a purchase. (Hybrids experienced this same curve themselves: While it took the Prius, Toyota’s flagship hybrid, 10 years to reach 1 million sales, it took only another two years for it to reach 2 million sales²²).

In the meantime, the auto industry needs to be responsive to the key pain points that consumers have identified as holding them back from buying an EV. Cost seems to be the most important among these issues, and the one that manufacturers are responding to in the short term: Ford has announced plans to develop a compact EV priced at $25,000,²³ while Rivian said in March 2024 that it would produce two lower-cost EV models (priced below $45,000 - an approximately $30,000 discount from the company’s currently available models).²⁴

This will likely be an important step in spurring demand, as current sales data already indicate there may be a degree of elasticity in demand dependent on price. In the current market, smaller, more affordable EVs are already selling better, though they are in shorter supply. According to CoPilot data, new EVs priced between $30,000 and $40,000 – while they make up just 4% of the market – have 65 market days supply (36% less than the market days supply for new EVs overall). At the opposite end of the spectrum, new EVs priced between $50,000 and $60,000 represent the largest share of the market (at 27.5%), but have a market days supply of 114 (which has increased by 34% in the last year).

In this context, Tesla’s ability to deliver an affordably-priced EV, as promised during its Q1 2024 earnings call, has become even more important. While CEO Elon Musk did not offer specifics on the timetable for when it would release a lower-priced EV, in the short term, Tesla is offering lease deals that effectively value its Model 3 close to $30,000. For instance, the Model 3’s current leasing terms are very similar to those being offered by the Honda Civic Sport – which has a current listing price of $25,500, compared to $38,990 for the Model 3. Yet its monthly payments are very similar ($257 for the Civic Sport, compared to $299 for the Model 3) and its down payments are exactly the same ($2,999). While the development of a Model 2, or another affordable EV, may not take place for some time, Tesla is already recognizing the importance of offering a more budget-conscious model by doing so in the form of leasing.

Until more affordable EVs are built, we will continue to see hybrids capitalize on their position as a happy medium: more eco-friendly than gas-powered cars, and more affordable and lacking many of the logistical headaches that EVs currently pose for consumers.

For consumers, this means the current moment represents a very favorable time to buy a used electric vehicle. Prices are down 8% this year alone, to an average of $37,708. While at this time last year, the average used EV was 55% more expensive than the average used car overall, today that difference has fallen to 39%.

Used Tesla prices have seen particularly substantial declines, in large part driven by price cuts to new models trickling into the used market. As a result, used Teslas have fallen by 36% in the past year to an average of $31,747. Some of its most popular models have also seen massive declines: For instance, since peaking in 2022, used Model S prices have dropped by 56% to an average of $32,582, and used Model 3 prices have fallen by 48% to an average of $26,785.

On the new side, there are also deals to be had for consumers: Since the start of 2024, new EV prices have fallen by $1,090 to an average of $64,146 – and some makes and models have seen even more substantial price declines, including:

- The Chevrolet Blazer, down by 20% (or $11,774) this year alone, to an average price of $48,426

- The Volkswagen ID.4, down by 17% (or $7,171) this year to an average price of $35,420

While the current moment is a challenging moment for EV manufacturers, it’s an opportune time for consumers considering an EV purchase – especially those for whom cost has posed the biggest obstacle. CoPilot predicts that, as automakers continue to manage the fall-out from their miscalculation on the technology adoption curve for EVs, consumers will benefit from significant discounts to both used and new EV prices through spring and summer of this year.

Appendix

1 Cox Automotive Forecast: U.S. Auto Sales Expected to Finish 2023 Up More Than 11% Year Over Year,

2 Electrified Transport Market Outlook 4Q 2023: Growth Ahead

3 EV euphoria is dead. Automakers are scaling back or delaying their electric vehicle plans

4 Hertz is dumping thousands of EVs. This may be why.

5 Hertz CEO out following electric car ‘horror show’

6 Fact #958: January 2, 2017 Sixty-three percent of all Housing Units have a Garage or Carport

7 EV charging needs big improvements soon if the auto industry’s transition is going to work

8 EV Leasing Volumes Poised to Surge as Tax Rule Makes It Cheaper to Lease than Buy

9 FOTW #1042, August 13, 2018: In 2017 Nearly 60% of All Vehicle Trips Were Less than Six Miles

11 Digging deeper into how temperature and speed impact EV range

12 Everything You Know About EV Repair Costs Is Wrong

13 The Real Reason EV Repairs Are So Expensive

14 As U.S. EV market flattens, some brands perk up and gain on Tesla

15 Rivals Nissan and Honda sign MoU on EV partnership

16 Meet the Tesla Diehards Sticking With the Stock Despite Its Disastrous Year

17 Tesla hikes discounts as EVs pile up

18 Is a Plug-In Hybrid Vehicle Right for You?

19 Toyota Remains World’s Top-Selling Carmaker

20 GM’s Going To Build Hybrids For Consumers Who Don’t Want EVs

21 Real World Usage of Plug-in Hybrid Vehicles in the United States

22 Worldwide Toyota Prius sales crack 2-million mark,10-year anniversary celebration planned

23 Ford CEO Jim Farley: Smaller, profitable EVs are nonnegotiable; UAW ‘relationship has changed’

24 Rivian Unveils Two Lower-Priced EVs as It Seeks to Jump-Start Sales

Popular Car Searches

Makes

Shop Used Cars

Used BMW Convertible for Sale Near Me

Used Nissan LEAF for Sale Near Seattle, WA

Used Hyundai Hatchback for Sale Near Me

Used Nissan JUKE for Sale Near Atlanta, GA

Used Audi Convertible for Sale Near Me

Used Subaru Crosstrek for Sale Near Seattle, WA

Used Cadillac Convertible for Sale Near Me

Used Honda Ridgeline for Sale Near Sacramento, CA

Used Subaru Impreza for Sale Near Denver, CO

Used BMW Roadster for Sale Near Me

Used Ford Mustang for Sale Near Sandy Springs, GA

Used Mazda Suv for Sale Near Me

Used Mitsubishi Wagon for Sale Near Me

Used Nissan Crossover for Sale Near Me

Used Toyota Tacoma for Sale Near El Paso, TX

Used Nissan GT-R for Sale Near Los Angeles, CA

Used Nissan Titan for Sale Near Trenton, NJ

Used Ford F-150 for Sale Near Jasper, AL

Used Ford Super Duty F-250 SRW for Sale Near Me

Used Alfa Romeo Coupe for Sale Near Me

Used Chevrolet Coupe for Sale Near Me

Used Ram Van for Sale Near Me

Used Audi Roadster for Sale Near Me