Used Car Prices Continue to Fall, But Ongoing UAW Strike Raises Questions About Market’s Continued Recovery

As the strike starts to bring down inventories of Big 3-produced domestic brands, new and used car prices have yet to increase – but soon will

Sales among older vehicles slow as consumers feel the sting of high interest rates and diminished savings

While Tesla remains the only brand priced below expected normal levels, used electric vehicle prices actually increased for the first time in a year amid surging demand

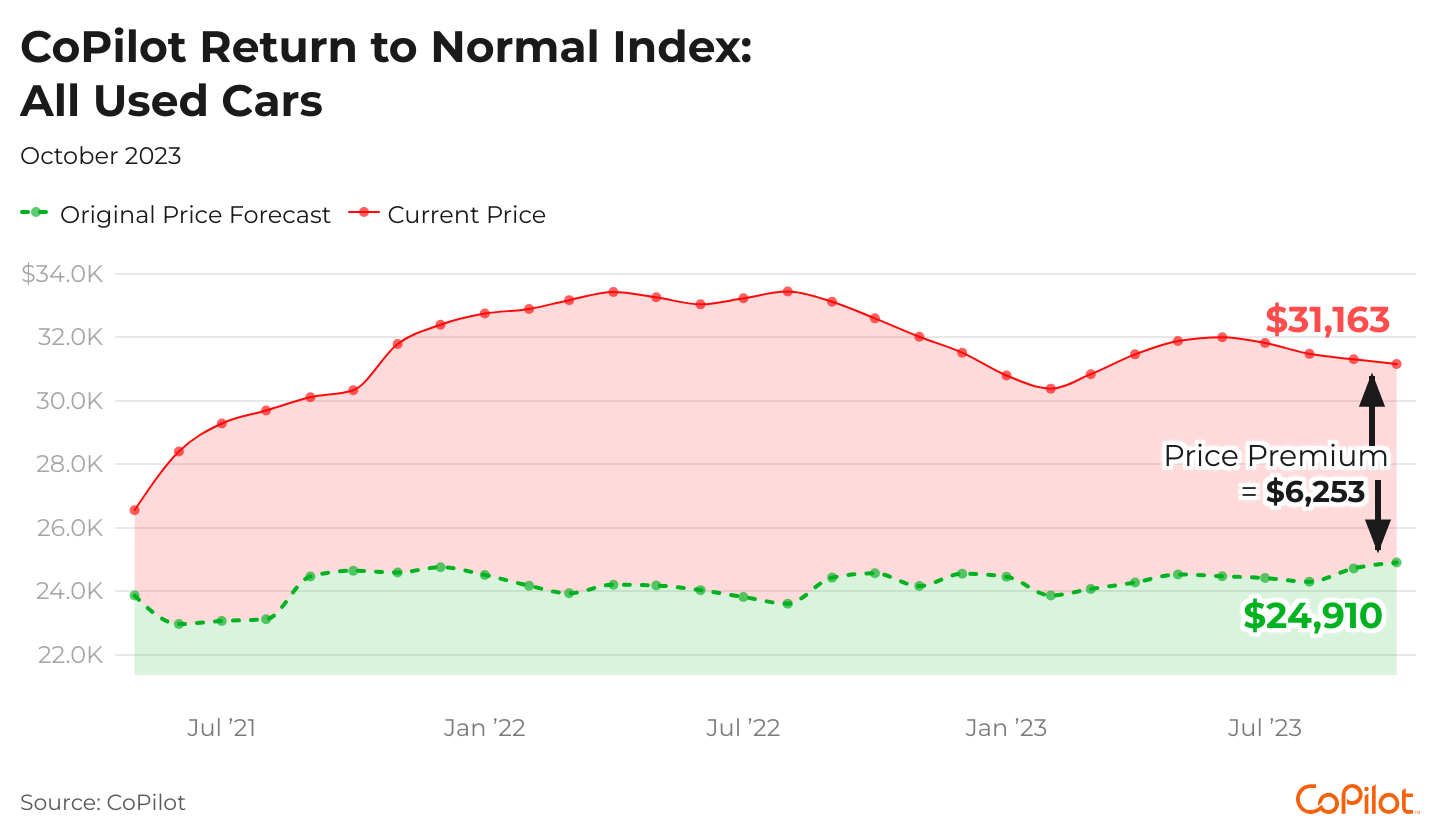

Chicago, IL – October 5, 2023 – While used car prices continued to fall in September, this rate of decline is slowing from the more substantial drops they saw over the summer, according to new data from leading AI-assisted car shopping app CoPilot. With an average listing price of $31,163, used cars are still priced $6,253 (or 25%) above where we would expect them to be in a normal, non-COVID economy, per the latest data from CoPilot’s Return to Normal Index.

Used car prices still remain elevated above the levels at which they started the year. For instance, used SUVs – which saw one of the most dramatic price increases in the spring – have an average listing price of $41,968, which is more than $1,600 above their price in January 2023. Additionally, their Price Premium is currently $5,830 (or 16%) above normal levels, compared to their January Premium of $4,871 (or 14%), indicating they have also become less affordable to consumers in real terms.

This is compounded by the fact that inventories for vehicles impacted by the ongoing UAW strike on the Big 3 automakers are already starting to deplete, raising questions around how the strike will impact the market’s future path toward recovery. For instance, the Jeep Gladiator (whose market days supply is down by 36% since September 10), the Chevrolet Colorado (down by 31%), and the Chevrolet Malibu (down by 22%) – and CoPilot expects prices will soon follow suit.

“While we haven’t seen car prices take a hit yet, that won’t be the case for long. Consumers unfortunately will soon feel the sting of the strike on top of the ongoing challenges of a car market that has yet to fully recover from the pandemic,” said Pat Ryan, CEO and Founder of CoPilot. “For those who do need to buy a car in the short term, Stellantis brands – including Jeep, Ram, and Dodge – are best-positioned to withstand a long strike, as they had the highest inventory levels when the strikes began. If you need to buy a car in the short term, one of these brands could be a strong bet.”

While new car sales have increased over the past month, up by 5% as consumers reacted to the possibility of strike-related price increases to come, demand for older used cars has dampened. Sales of 8-13 year old cars fell by 4% in September, while those of 4-7 year old vehicles fell by 3%, as still-elevated interest rates and dwindling pandemic-era savings place more constraints on consumers.

“Used car prices haven’t fallen enough to make a material difference for most consumers, especially if they need to finance their vehicle,” Ryan added. “Many brands and segments are still priced higher than they were at the start of the year. At the same time, all but the wealthiest Americans have run through their pandemic-era excess savings – and multiple interest rate hikes have drastically increased the cost of owning a car for those taking out a loan. These sales declines among older vehicles indicate that the average American consumer continues to be priced out of the used car market.”Used Teslas remain one of the consistently best values in the used car market, as the only brand in CoPilot’s Index that is currently priced below normal levels, at priced $526 (or 1%) below normal. However, amid surging demand and dwindling supply, used electric vehicles overall actually increased in price in September, by 1%, for the first time in over a year.

About CoPilot

CoPilot is the leading AI-assisted car shopping app, providing consumers with an expert partner for high-consideration purchases, starting with car buying and ownership. The platform combines massive real-time data with a winning combination of human expertise and AI-powered search to introduce transparency to the shopping, purchasing and ownership journey. The mobile application takes the time, frustration, and guesswork out of the process, empowering people to easily navigate the risks of shopping for high-value items, and to buy with confidence at the right price and the right time.

CoPilot provides free AI-powered search and pricing tools for consumers. CoPilot’s AI-powered Model Discovery Tool provides car comparisons and model recommendations, serving as an intelligent agent to make AI actionable for car shoppers. The tool applies CoPilot’s proprietary analytics to the company’s comprehensive listings database, in order to save time, money, and frustration for car shoppers. The user-friendly chat interface delivers AI-powered analysis to recommend and rank the best cars that meet each shopper’s specific needs within their chosen geographic area. Additionally, CoPilot’s ChatGPT plugin is the first to rank and return real-time listings within ChatGPT’s chat interface.

CoPilot’s pricing tool, Price Pulse, makes it easy for car shoppers to check the current market value and Price Premium for any car, helping them to know what and when to buy, sell or trade-in, using the same data only dealers used to have.

For media publishers, CoPilot offers free, embeddable data tools, including Price Pulse market trends, allowing journalists and bloggers to integrate interactive charts and tables within their web content, apps, or newsletters, powered by CoPilot’s unique data and analytics. Follow CoPilot on Twitter here for original data and insights.

Media Contact:

Kerry Close

732-609-2644

Popular Car Searches

Makes

Shop Used Cars

Used Hyundai Sedan for Sale Near Me

Used Honda CR-V for Sale Near Seattle, WA

Used Ford Ranger for Sale Near Cincinnati, OH

Used Honda CR-V for Sale Near Coral Springs, FL

Used Honda HR-V for Sale Near Albany, NY

Used Subaru Forester for Sale Near Oklahoma City, OK

Used Subaru Outback for Sale Near Minneapolis, MN

Used Nissan Altima for Sale Near Fontana, CA

Used Toyota Camry for Sale Near Me

Used Ford Explorer for Sale Near Centennial, CO

Used Volkswagen Hatchback for Sale Near Me

Used Nissan Armada for Sale Near Seattle, WA

Used Buick Suv for Sale Near Me

Used Mitsubishi Truck for Sale Near Me

Used Honda CR-V for Sale Near Myrtle Beach, SC

Used Honda Accord Sedan for Sale Near Albany, NY

Used Honda CR-V for Sale Near Huntsville, AL

Used Nissan Murano for Sale Near Me

Used Honda Pilot for Sale Near Me

Used Chrysler Minivan for Sale Near Me

Used Ford Minivan for Sale Near Me

Used Nissan Hatchback for Sale Near Me

Used Genesis Suv for Sale Near Me