Demand Outpaces Supply in the Used Car Market as Consumers Remain Surprisingly Strong

New cars represent slightly better value for consumers as their inventory finally replenishes, though a potential UAW strike creates more questions around the car market’s road to normal

Used electric vehicle prices remain in freefall, as Tesla price cuts ripple through the market, and used Teslas are the only brand currently priced below normal levels

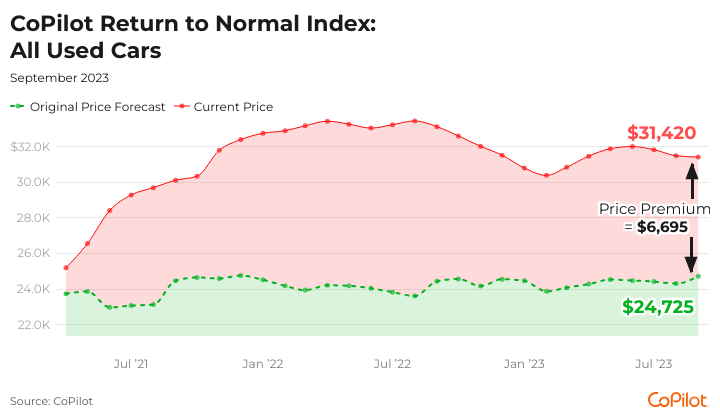

Chicago, IL – September 6, 2023 – Both a strong consumer and vehicle supply bottlenecks are keeping used car prices elevated, according to new data from CoPilot, the leading AI-assisted car shopping app. In August, used cars had an average listing price of $31,420, which is $6,695 (or 27%) above projected normal levels. Due to continued new supply issues, as well as a shortage of rental car inventory and off-lease vehicles, eager consumers are faced with dwindling levels of inventory (at just 37 market days supply) – but are still buying, with sales up 4% in the past three months alone. Consequently, used car prices are still $612 higher than they were at the start of the year.

Furthermore, as a potential UAW strike looms – possibly creating additional production delays among new vehicles manufactured by the Big Three domestic auto brands – CoPilot predicts that both new and used car prices will likely remain elevated for some time.

Consumer demand is strongest in the older part of the used car market, where prices of 4-7 year old cars and 8-13 year old cars (both down by 6% this year) have fallen more substantially than those of 1-3 year old cars (down less than 1% since January). However, with an above-average 44 market days supply, 1-3 year old prices could fall more significantly in the future as dealers may finally be forced to lower prices to move inventory.

“While used car prices continue to fall from their peaks earlier this spring, their rate of decline is slowing. Strong demand is allowing dealers to hold onto near-record-high prices a little longer, especially among the most expensive used cars that experienced the biggest price increases in the spring,” said Pat Ryan, CEO and Founder of CoPilot. “The story of the used car market is one of supply and demand. Affluent consumers in particular are continuing to buy, keeping inventory levels below pre-COVID norms, and thus prices elevated. The used car market remains a major signal of the strength and resilience of the consumer, and the challenges that the Federal Reserve has faced in fully tamping down on inflation.”

Among new cars, supply issues are starting to ease, and a number of brands have a market days supply well above the average (of 51) for new cars. However, the pending UAW strikes among the Big Three automakers – GM, Ford, and Stellantis – will put renewed pressure on new supply, especially among GM brands, which have the lowest new inventory levels (for instance, Chevrolets have 49 market days supply, while Cadillacs have 40).

While Ford and Stellantis will also experience production bottlenecks should the strike occur, it will take longer for its impacts to be felt among these brands. Ford vehicles have an average market days supply of 70 days, while Stellantis brands Dodge and Chrysler, for instance, have 117 and 108 days supply, respectively (more than double the average for new brands).

“As the car market finally starts to recover from the COVID era, the UAW strike may be yet another wrench in their road back to normal,” Ryan added. “With GM likely to experience the most significant immediate impact, consumers who are interested in these vehicles, and who need a car in the short term, should seriously consider making a purchase before the market starts to experience the effects of this potential strike.”

However, a continued bright spot in the market is Teslas and electric vehicles. Prices of used electric vehicles, and Teslas in particular, continue to tumble – down 17% and 21%, respectively, since the start of the year – as the impacts of Tesla price cuts persist through the market. Additionally, used Teslas are the only brand priced below normal levels, priced $245 (or 0.6%) below normal levels.

Another factor pushing down electric vehicle prices is waning consumer interest: At 81 days market supply, inventory levels remain well above current average levels for the new car market, and some models – including the Nissan Leaf (131 days supply) and the Ford Mustang Mach-E (117 days supply) – have supply well above this level.

About CoPilot

CoPilot is the leading AI-assisted car shopping app, providing consumers with an expert partner for high-consideration purchases, starting with car buying and ownership. The platform combines massive real-time data with a winning combination of human expertise and AI-powered search to introduce transparency to the shopping, purchasing and ownership journey. The mobile application takes the time, frustration, and guesswork out of the process, empowering people to easily navigate the risks of shopping for high-value items, and to buy with confidence at the right price and the right time.

CoPilot provides free AI-powered search and pricing tools for consumers. CoPilot’s AI-powered Model Discovery Tool provides car comparisons and model recommendations, serving as an intelligent agent to make AI actionable for car shoppers. The tool applies CoPilot’s proprietary analytics to the company’s comprehensive listings database, in order to save time, money, and frustration for car shoppers. The user-friendly chat interface delivers AI-powered analysis to recommend and rank the best cars that meet each shopper’s specific needs within their chosen geographic area. Additionally, CoPilot’s ChatGPT plugin is the first to rank and return real-time listings within ChatGPT’s chat interface.

CoPilot’s pricing tool, Price Pulse, makes it easy for car shoppers to check the current market value and Price Premium for any car, helping them to know what and when to buy, sell or trade-in, using the same data only dealers used to have.For media publishers, CoPilot offers free, embeddable data tools, including Price Pulse market trends, allowing journalists and bloggers to integrate interactive charts and tables within their web content, apps, or newsletters, powered by CoPilot’s unique data and analytics. Follow CoPilot on Twitter here for original data and insights.

Media Contact:

Kerry Close

732-609-2644

Popular Car Searches

Makes

Shop Used Cars

Used Ford Explorer for Sale Near Salem, OR

Used Honda Odyssey for Sale Near Omaha, NE

Used Honda Ridgeline for Sale Near Sacramento, CA

Used Alfa Romeo Coupe for Sale Near Me

Used Nissan Maxima for Sale Near Me

Used Toyota Coupe for Sale Near Me

Used Nissan Sentra for Sale Near Renton, WA

Used Toyota Hatchback for Sale Near Me

Used Toyota RAV4 for Sale Near Me

Used Lincoln Limousine for Sale Near Me

Used Hyundai Minivan for Sale Near Me

Used FIAT Suv for Sale Near Me

Used Honda Fit for Sale Near Portland, OR

Used Ford Fiesta for Sale Near Pittsburgh, PA

Used MINI Coupe for Sale Near Me

Used Ram Van for Sale Near Me

Used Ford Mustang for Sale Near Sandy Springs, GA

Used Nissan Altima for Sale Near Boston, MA

Used Lexus Suv for Sale Near Me

Used Toyota RAV4 for Sale Near Lexington, KY

Used Toyota Sedan for Sale Near Me

Used Land Rover Suv for Sale Near Me

Used Nissan Altima for Sale Near Austin, TX