Consumers Flock to the New Car Market As Inventory Finally Rebounds

Manufacturers ramp up vehicle production in early 2023, starting to ease long-standing supply issues and pulling consumers who had been waiting to buy a new car off the sidelines

Prices of 1-3 year old cars – often relied upon as a substitute for new vehicles – show most substantial declines as consumers buy new cars instead

Used Teslas represent the best deal in the used car market, down in price by 35% over the past year

Chicago, IL – July 6, 2023 – Strong sales numbers in the new car market are finally slowing down consumer demand for used cars, according to new data from leading car shopping app CoPilot. As vehicle manufacturers responded to new and used car inventory shortages by accelerating production in the first half of 2023, many consumers, who had been holding off, capitalized on the opportunity to finally buy a new car. This surging demand for new cars consequently cooled demand in the used car market, where sales slowed, inventory rose, and prices fell for the first time this year.

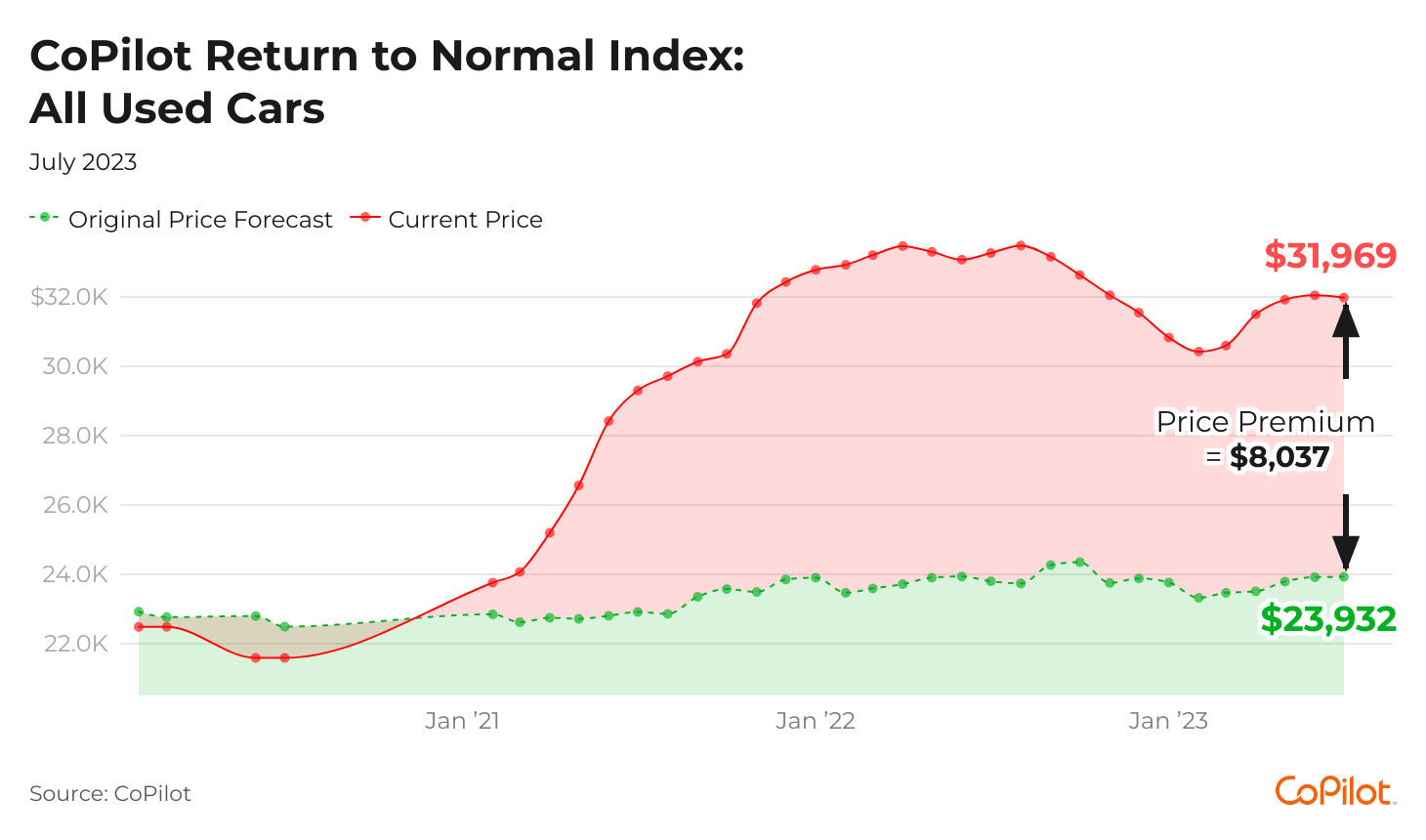

Used car prices, which had jumped by 5% between January and May, fell by $66 in June, now averaging $31,969. Sales volumes of used vehicles, which had surged by 10% between January and May, increased by just 1% this month, another indication of slowing consumer demand.

These price declines were led by nearly-new (1-3 year old) cars, which fell in price by $500 in June, after jumping by 5% in the first half of the year. The Premium for nearly-new vehicles also dropped by 5%, as consumers, who traditionally turned to these cars as substitutes for new cars during the pandemic, instead bought new vehicles as supply finally replenished. Similarly, used SUV and truck prices – which had seen massive increases in the spring, up 8% and 5%, respectively – also started to level off in July amid slowing sales.

“The new car market is coming back as supply finally starts to replenish, and consequently, consumers are becoming less interested in buying used cars,” said CoPilot CEO and Founder Pat Ryan. “Even while the impacts of the current economic slowdown remain concentrated among the most affluent consumers, causing what’s been termed a ‘richcession,’ this group is still buoyed by strong consumer confidence and pent-up savings from the pandemic. As a result, they’re still buying new cars at near-record high prices – and we expect this strong demand to persist at least through the summer buying season.”

“In the long term, however, the outlook for the car market depends on vehicle manufacturers’ next move: if they’ll continue to produce more vehicles to meet demand, and finally start to stabilize prices,” Ryan added. “The next several months will be very telling in terms of what the new normal will look like for car shoppers.”

As used car prices start to drop off, used Teslas are showing the most significant price declines. Used Teslas have fallen by $7,141 (or 13%) since price cuts to new models were announced in December 2022, and by $24,955 (or 35%) year-over-year. They are currently priced $6,484 (or 12%) below projected normal levels, the first brand to reach normal levels, according to CoPilot’s Return to Normal Index, representing the best value in the used car market.

Similarly, as impacts from price cuts to new Tesla models continue to ripple through the market, used EVs – now listed an average price of $44,160 – continue to see massive price declines, down $23,245 (or 34%) in the past year.

Bucking this trend of used car price declines, however, are used minivans, which have increased in price by 7% since February. Now with an average listing price of $25,092, used minivans are currently priced $7,464 (or 42%) above projected normal levels, as their supply barely keeps up with demand, making minivans the best cars to sell or trade in now.

“Despite used car prices starting to fall, it remains a very tough time to buy, especially for consumers in the market for more affordable vehicles, or for popular segments like minivans,” Ryan said. “While we may see more relief on pricing in the second half of 2023, with supply yet to fully recover and interest rates still high, it will likely be a long time before used cars become significantly more affordable to consumers in real terms.”

About CoPilot

CoPilot is a leading car buying app that provides consumers with an expert partner for high-consideration purchases, starting with car buying and ownership. The platform combines massive real-time data with a winning combination of human expertise and AI-powered search to introduce transparency to the shopping, purchasing and ownership journey. The mobile application takes the time, frustration, and guesswork out of the process, empowering people to easily navigate the risks of shopping for high-value items, and to buy with confidence at the right price and the right time.

CoPilot provides free AI-powered search and pricing tools for consumers. CoPilot’s AI-powered discovery tool provides car comparisons and model recommendations. The CoPilot plugin is the first to rank and return real-time listings within ChatGPT’s chat interface. Price Pulse makes it easy for car shoppers to check the current market value and Price Premium for any car, helping them to know what and when to buy, sell or trade-in, using the same data only dealers used to have.

For media publishers, CoPilot offers free, embeddable data tools, including Price Pulse market trends, allowing journalists and bloggers to integrate interactive charts and tables within their web content, apps, or newsletters, powered by CoPilot’s unique data and analytics. Follow CoPilot on Twitter here for original data and insights.

View this month’s Index Report findings here.

Media Contact:

Kerry Close

732-609-2644

Popular Car Searches

Makes

Shop Used Cars

Used BMW Roadster for Sale Near Me

Used Kia Suv for Sale Near Me

Used Nissan Frontier for Sale Near Me

Used Ford Transit Cargo Van for Sale Near Me

Used Ford Super Duty F-350 SRW for Sale Near Me

Used Dodge Wagon for Sale Near Me

Used Dodge Suv for Sale Near Me

Used Volvo Wagon for Sale Near Me

Used Mazda Suv for Sale Near Me

Used Ford Mustang for Sale Near Jacksonville, FL

Used Ford Transit Connect Wagon for Sale Near Queens, NY

Used Nissan JUKE for Sale Near Me

Used Mitsubishi Wagon for Sale Near Me

Used BMW Convertible for Sale Near Me

Used Honda CR-V for Sale Near Coral Springs, FL

Used Chrysler Minivan for Sale Near Me

Used MINI Hatchback for Sale Near Me

Used Ford Coupe for Sale Near Me

Used Land Rover Suv for Sale Near Me

Used Lexus Coupe for Sale Near Me

Used Audi Sedan for Sale Near Me

Used Lexus Hatchback for Sale Near Me

Used Ford Mustang for Sale Near Sandy Springs, GA