CoPilot’s Return to Normal Index

October 2022 Report

EXECUTIVE SUMMARY: SEPTEMBER 2022 DATA

CoPilot’s Return to Normal Index shows the differential between what any used car price would have been today if not for the extraordinary dynamics of the past two years, versus how much it is actually worth now, at retail. As it tracks this differential over time, the Return to Normal Index provides the only real-time barometer of the used car market’s recovery, as well as how close individual vehicle segments, brands, and age brackets are to returning to normal pricing levels.

As of September 30, 2022, CoPilot’s Return to Normal Index found:

- Prices have begun to fall rapidly for used cars, reflecting significant weakening of demand. Prices remain historically high, however, and are likely to fall further and faster in the months ahead, compounded by macro and supply-side factors.

- Overall used car listing prices fell for the second straight month in September, to an average of $32,711. At 2%, this month’s drop was twice as fast as August’s, and is the largest monthly drop since the start of the COVID-19 pandemic.

- September used car Price Premiums averaged $8,110 (or 33%) above projected normal levels. This represents a 6% decrease from last month’s index, the second consecutive monthly decline, and a massive 17% drop since Premiums peaked at 41% in July.

- As demand weakened, most age brackets, segments, and brands saw significant declines in price. Amid back-to-back interest rate hikes and ongoing inflation, consumers are signaling that they won’t pay near record-high used car prices – causing the market to fall significantly.

- Used electric vehicles and hybrids have fallen in price more than other vehicle types – by 11% and 8%, respectively, since July peaks – as both have continued to see their inventory swell in recent months.

- While CoPilot’s September data show that price drops in the used car market are now widespread and accelerating, the overall Price Premium of 33% shows there is still a long way for used car prices to fall before they reach normal levels.

- CoPilot expects further and faster price drops in the months ahead, as macro-economic factors weaken demand, dealers seek to manage risk, and new car shipments eventually restore inventory levels (as expected in 2023). These compounding forces of supply and demand will only accelerate price corrections.

- Falling prices create long-awaited opportunity for consumers who are ready to buy. Those looking to sell or trade-in should act fast.

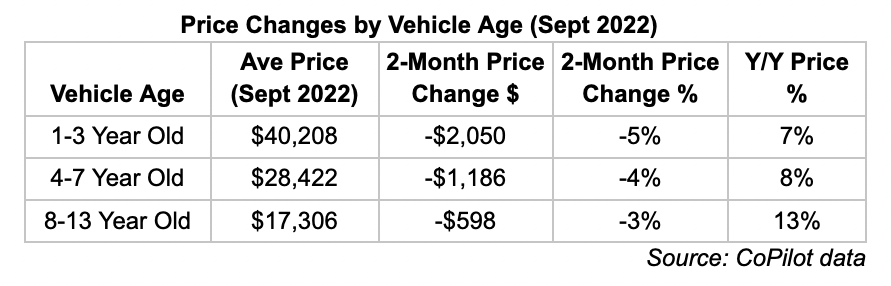

PRICE PREMIUM BY VEHICLE AGE

Within the overall market, newer used car prices were the last to peak, but are now dropping most quickly, accelerating their fall in September. Meanwhile, the listing price of older models, which has been falling for longer, dropped less significantly in September.

In September, nearly-new (1-3 year old) cars were listed at an average price of $40,208, down over $2,000, or nearly 5%, from two months ago.

- The September Price Premium for 1-3 year old cars was $10,353 above projected normal levels – dropping in three months from 43%, the highest Premium, to 35%. Its Premium is now the lowest among the three age brackets analyzed in the Return to Normal index report.

- The Price Premium for 1-3 year old cars dropped faster in September than any previous month, and is down 17% over the past two months.

Listing prices of 4-7 year old pre-owned cars declined in September. Their average price was $28,442, down 4% over the past two months, and down 9% since the beginning of the year.

- These price drops are also accelerating, dropping 2.2% month-over-month in September, compared to its 1.8% decline in August. This is also the largest price drop for this age bracket since 2020.

- The Price Premium for 4-7 year old cars in September was $7,651, or 37%, above projected normal levels – a substantial 12% drop in Premium since July.

Older used vehicle (8-13 years old) prices trended downward in September. Their average listing price was $17,306, down 3% over the past eight weeks, and marking the sixth consecutive month of price decreases for this age bracket.

- The Price Premium for 8-13 year old cars in September was $4,776, or 38%, above projected normal levels, translating to an 8% decline in Premium over the past two months.

PRICE PREMIUM BY TYPE OF VEHICLE

With gas prices still nearly 20% higher than they were last year, used SUVs and trucks continue to trend downward in price. For the fifth consecutive month, both segments remain the closest to returning to normal pricing levels.

In September, used SUVs had an average listing price of $42,607, representing a 5% decline since their peak in early March.

- At $7,461, the Price Premium for used SUVs has dropped to 21% above normal expected prices.

- By comparison, in August, the Price Premium for used SUVs was $8,374, or 24%, above projected normal.

- Used SUVs continue to have the smallest Price Premium by percentage of all vehicle segments, and thus are the segment relatively closest to returning to normal pricing levels.

- Used SUVs have been falling steadily in price since March, when gas prices first started to increase and consumer appetite for gas-guzzling vehicles consequently cooled. The Price Premium for used SUVs has fallen by a staggering 30% over the past six months (from a Premium of $10,645 at the start of March).

In September, used pickup trucks were listed at an average price of $41,244.

- In September, used pickup trucks had the second-smallest Price Premium of all vehicle segments, at $8,945, or 28% above projected normal levels.

- This represents a 6% decline in the Premium for used pickup trucks since July. September also marks the second consecutive month in which the Price Premium for used pickup prices has declined.

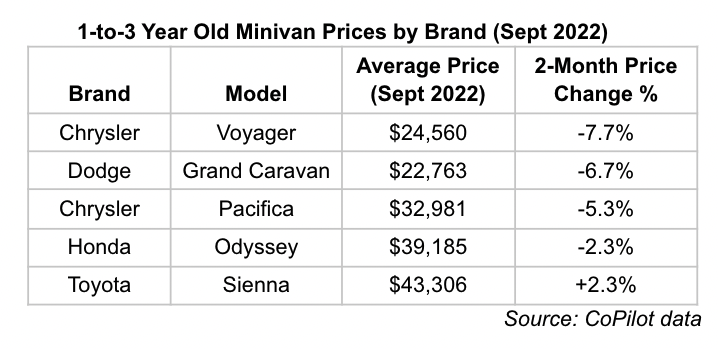

Minivans are the only used vehicle segment not to see an absolute price drop since July.

- Minivans have been relatively stable, holding steady within $50 of September’s average price of $25,437 for the past four months.

- The Price Premium for minivans has also been relatively stable, falling from $7,658 (or 43%) in August to $7,419 (or 41%) in September.

- Even among minivans, the 1-to-3 year old models are dropping – by $1,000 or 3% in two months.

- Among the major minivan brands, American buyers are expressing their preference for imports. 1-to-3 year old Honda and Toyota minivans are not only significantly more expensive than their American counterparts, they have also shown more price resilience. Toyota’s Sienna is the only high volume minivan to have gone up in price (by 2%) from July to September. Honda’s Odyssey dropped, but only by 2%, compared to price cuts of 5-8% for American minivan brands.

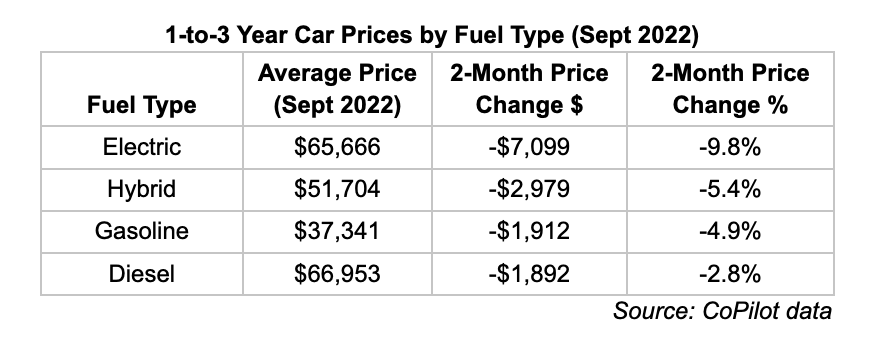

PRICE PREMIUM BY FUEL TYPE

As electric vehicles gain more mainstream popularity and become increasingly available, and with gas prices falling again in September, used electric vehicles continue to drop substantially in price.

In September, used electric vehicles were listed at an average price of $60,550 - a staggering 11% drop since their peak price levels in July, when gas prices first started to ease.

Used Tesla prices fell again in September, to an average of $63,295, down nearly $3,000 from their August levels.

The Price Premium for used Teslas also fell in September, now listing at $17,322 or 38%, above projected normal levels.

This represents the third consecutive month in which the Price Premium for used Teslas has declined - and a 26% decline in Price Premium since it peaked at 50% above normal levels in June.

Used hybrid prices also fell for the third consecutive month, now listed at an average price of $45,872, and representing another 3% month-over-month decrease. Used hybrid prices have dropped by a substantial 8% since peaking at $49,829 in mid-July.

The table below compares prices and 2-month price drops for 1-to-3 year old cars by fuel type.

PRICE PREMIUM BY BRAND

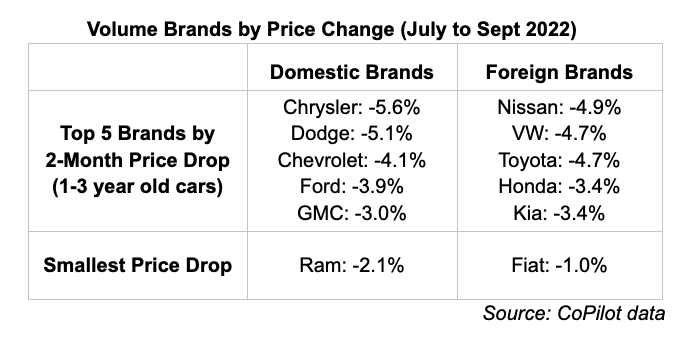

Of the 47 brands analyzed by CoPilot, only three small brands did not see their average price drop between July to September 2022 (Smart, Mini, and Hummer). Every brand saw 1-3 year old car prices drop from July to September, with Tesla dropping the most of any significant brand – by a staggering 9%. Among the largest brands, foreign cars dropped less than their domestic counterparts.

Domestic Brands:

In September, the Price Premium for high-volume domestic brands averaged $7,809, or 32%, above projected normal levels.

- This represents a massive 19% drop in Premium from July, when domestic brands were priced $9,689, or 41%, above projected normal levels.

Used Ram vehicles had the highest absolute Price Premium among domestic brands, listed at $9,882, or 30%, above projected normal levels.

They were followed by used Fords, listed at $8,733, or 36%, above projected normal levels, and Chevrolet at $8,572, or 37% above projected normal levels.

Foreign Brands:

In September, the Price Premium for high-volume foreign brands averaged $7,939, or 44%, above projected normal levels.

- With the August Premium for foreign brands at $8,477, or 48%, above normal levels, this represents a 6% drop in Premium in the past month alone.

Used Volkswagen vehicles once again had the highest absolute and relative Price Premium among foreign brands, listed at $9,167, or 59%, above projected normal levels.

Used Kias had the second-highest absolute Price Premium among foreign brands, listed at $8,370 (or 53%) above projected normal levels.

They were trailed by used Toyotas, which had an average listing price of $8,253 above projected normal levels, representing a smaller, 38%, relative premium, due to the higher average listing price of Toyota.

Luxury Brands:

In September, the Price Premium for luxury brands averaged $10,631, or 33%, above projected normal levels.

- This represents a 6% decrease from July, when the Price Premium for luxury brands was $11,299, or 35%, above projected normal levels.

Used Porsches had the highest absolute Price Premium among luxury brands, listed at $22,110, or 36%, above projected normal levels.

Used Teslas had the second-highest Price Premium among luxury brands, listed at $17,322 or 38%, above projected normal levels. They were followed by used Cadillacs, which were listed at $10,116, or 35%, above projected normal levels.

ANALYSIS AND CONCLUSIONS

Used car prices increased by 50% from 2020 to 2022. Older vehicle prices began to peak and soften in Q1 2022, but price drops were not sustained across the market. After peaking in July, however, overall used car prices first began to decline more seriously in August, and accelerated their fall in September, a trend seen across almost all vehicle age brackets, segments, fuel types, and brands. As consumers grapple with the triple-whammy of soaring inflation, high gas prices, and multiple interest rate hikes, their willingness to pay record-high prices has significantly receded. The likelihood of even higher interest rates to come, driving up loan payments on already inflated car prices – plus the prospect of economic recession – is making many buyers even more cautious. As a result, dealers are being forced to finally lower their prices, to hit sales targets and to offload inventory before it depreciates further.

CoPilot’s advice to retail car buyers is to be patient if you can. After two years of a seller’s market, the power is starting to shift in favor of the buyer. If you must buy a car now, you have more negotiating leverage than at any time for many months. However, with prices falling by 2% per month, wait if you can, monitor the market vigilantly, and negotiate hard when the time comes to buy.

While prices have started to fall, we expect them to fall further and faster, offsetting the pace of interest rate increases in the next three to six months, and accelerating even further when more new car supply eventually re-enters the market, as expected in early 2023. Additionally, as used cars are clearly falling off their peak pricing levels, now is the time for those with a used car to sell or trade in to make their move and lock in a great price, before the market corrects more significantly.

Consumers can look up the real-time value and the Price Premium for any individual car they are looking to buy, or calculate the current trade-in value for their own car at www.copilotsearch.com/pricepulse, and can calculate the current trade-in value for their own car at www.copilotsearch.com/hiddenprofit.

METHODOLOGY

The Return to Normal Index is drawn from data collected by leading car shopping app CoPilot. CoPilot’s data and proprietary methodology track the online inventory of virtually every dealer in the country, every day, offering real-time analysis around car prices, inventory, and sales. This October report covers data through September 30, 2022. Data and methodology have been refined in this report, for increased sensitivity to market fluctuations. Data may adjust in future, due to changes in methodology and as additional data sources are integrated.

CoPilot provides free pricing tools for consumers. Price Pulse makes it easy for car shoppers to check the current market value and Price Premium for any car, track price changes, and compare years and models to choose the right car and know when to buy. For car owners and sellers, Price Pulse calculates the real-time value of their car, using the same data only dealers used to have, allowing consumers to track how much their vehicle has appreciated, so they can decide whether and when to sell, or negotiate the best deal at trade-in or lease-end. For media publishers, CoPilot offers embeddable data tools, allowing journalists and bloggers to integrate interactive charts within their web content, apps, or newsletters, powered by CoPilot’s unique data and analytics.

Media Contact:

Kerry Close

732-609-2644

Popular Car Searches

Makes

Shop Used Cars

Used Kia Suv for Sale Near Me

Used Toyota RAV4 for Sale Near Me

Used Toyota Convertible for Sale Near Me

Used Subaru BRZ for Sale Near Seattle, WA

Used Subaru Outback for Sale Near Norwich, CT

Used Nissan Murano for Sale Near Trenton, NJ

Used Toyota Highlander for Sale Near Me

Used BMW Suv for Sale Near Me

Used Audi Hatchback for Sale Near Me

Used Ford Mustang for Sale Near Concord, NC

Used Toyota Hatchback for Sale Near Me

Used Subaru Outback for Sale Near Anchorage, AK

Used Acura Hatchback for Sale Near Me

Used MINI Wagon for Sale Near Me

Used Alfa Romeo Convertible for Sale Near Me

Used Toyota Highlander for Sale Near Richmond, VA

Used Ford Explorer for Sale Near Centennial, CO

Used Toyota Truck for Sale Near Me

Used Subaru Coupe for Sale Near Me

Used Nissan JUKE for Sale Near Me

Used Mazda Suv for Sale Near Me

Used Buick Convertible for Sale Near Me

Used Toyota Tacoma for Sale Near Richmond, VA