The Impact Of The UAW Strike In 5 Charts

Source: iStock

While used car prices continued to fall in September, this rate of decline is slowing from the more substantial drops they saw over the summer. Used car prices are still elevated above the levels at which they started the year. This is compounded by the fact that inventories for vehicles impacted by the ongoing UAW strike on the Big 3 automakers are already starting to deplete, raising questions around how the strike will impact the market’s future path toward recovery.

“While we haven’t seen car prices take a hit yet, that won’t be the case for long. Consumers unfortunately will soon feel the sting of the strike on top of the ongoing challenges of a car market that has yet to fully recover from the pandemic,” said Pat Ryan, CEO and Founder of CoPilot. “For those who do need to buy a car in the short term, Stellantis brands – including Jeep, Ram, and Dodge – are best-positioned to withstand a long strike, as they had the highest inventory levels when the strikes began. If you need to buy a car in the short term, one of these brands could be a strong bet.”

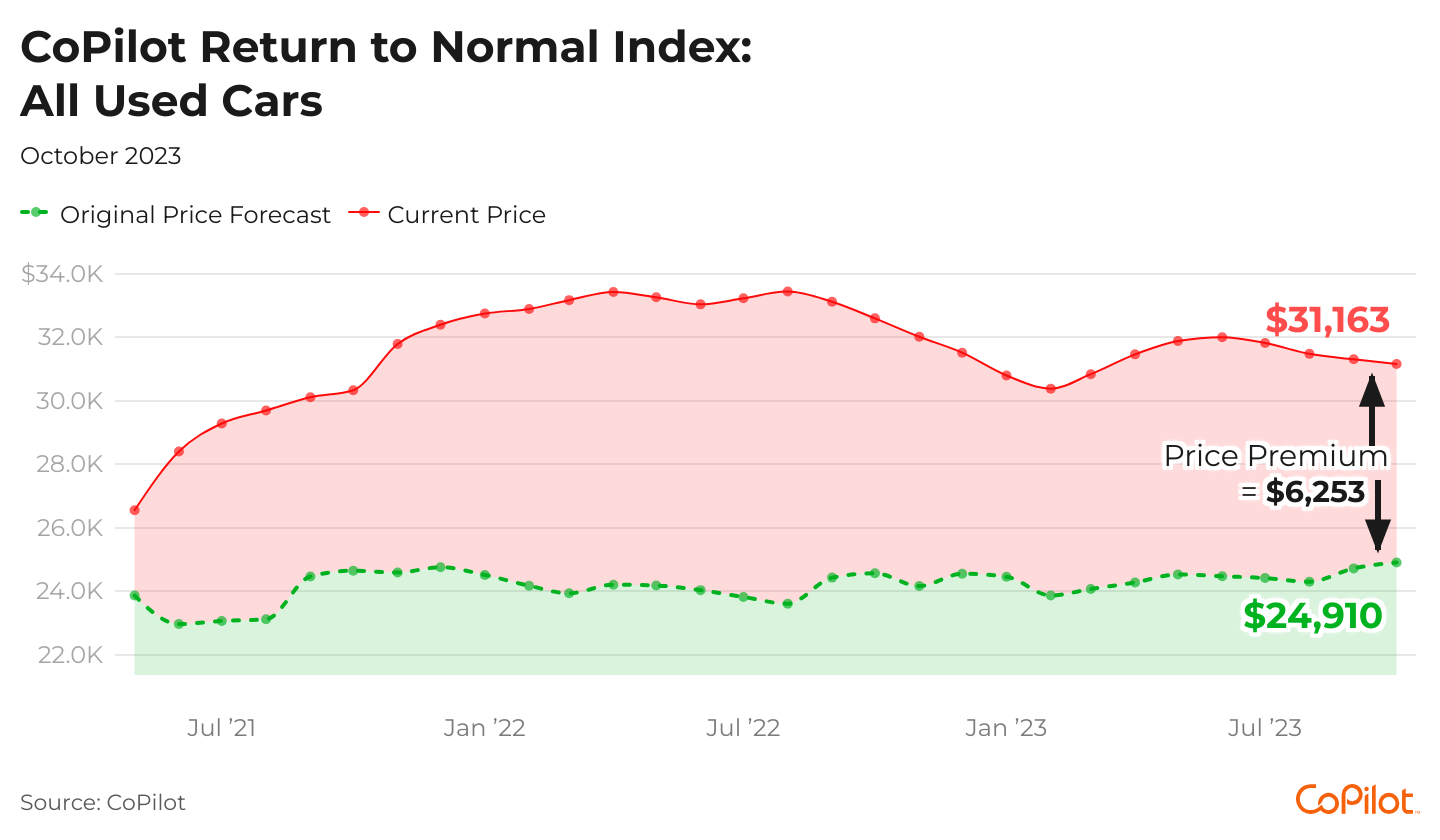

Using its PricePulse data set, CoPilot measures the difference between what any used car price would have been today, if not for the extraordinary dynamics of the past two years, versus how much it is actually worth now, at retail.

CoPilot

Used Car Prices Are Still Inflated

With an average listing price of $31,163, used cars are still priced $6,253 (or 25%) above where we would expect them to be in a normal, non-COVID economy. In fact, used cars overall still remain $360 higher than the price levels at which they started the year.

“Used car prices haven’t fallen enough to make a material difference for most consumers, especially if they need to finance their vehicle,” Ryan added. “Many brands and segments are still priced higher than they were at the start of the year. At the same time, all but the wealthiest Americans have run through their pandemic-era excess savings – and multiple interest rate hikes have drastically increased the cost of owning a car for those taking out a loan. These sales declines among older vehicles indicate that the average American consumer continues to be priced out of the used car market.”

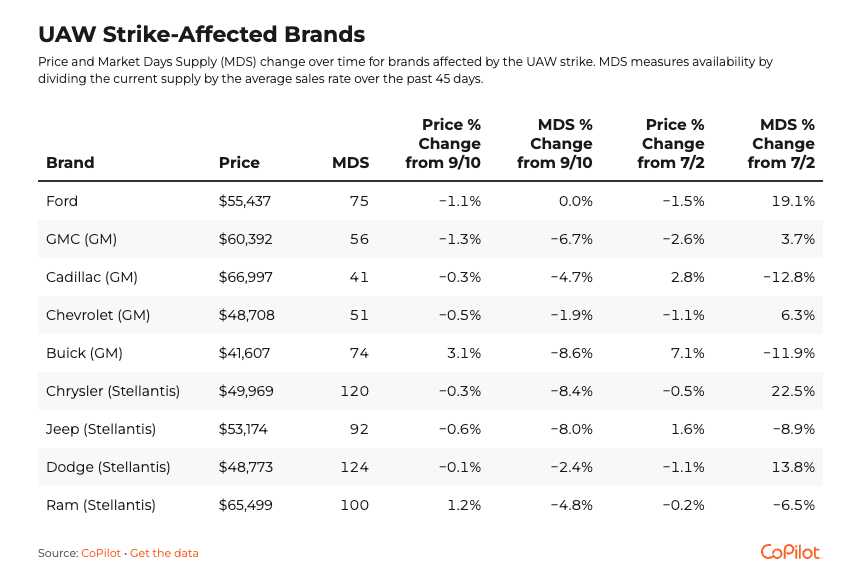

How the UAW Strike Is Affecting Car Brands

The UAW strike began September 15, 2023 and affected Detroit’s Big Three automobile manufacturers: Ford, General Motors, and Stellantis. The table above shows the UAW strike impact on affected domestic car brands. Note that MDS measures availability by dividing the current car supply by the average sales rate over the past 45 days.

In general, Price Premiums for domestic brands fell by 5% in September. But, affordability for domestic brands will remain in question as the UAW strikes start to impact new car inventory and eventually potentially trickle into the used car market. As the strike continues, affected vehicle models are unlikely to see an increase in supply, meaning future price increases are largely inevitable.

CoPilot

Domestic Car Models Affected By The UAW Strike

On September 15th, the UAW strike halted production at three plants producing the Ford Bronco, Jeep Wrangler, Chevrolet Colorado, and other popular models. On September 29th the strike continued to Ford’s Chicago, IL assembly plant and GM’s Lansing, MI assembly plant. This spread the strike’s impact to more models, including the Chevy Traverse and Ford Explorer.

Availability of models produced at the affected plants is starting to struggle. The Jeep Gladiator’s market days supply is down by 36% since September 10, the Chevrolet Colorado is down by 31%, and the Chevrolet Malibu is down by 22% – and CoPilot expects prices will soon follow suit.

CoPilot

Older Vehicle Sales Slow Amid High Rates & Low Savings

Each vehicle age bracket continues to see steady price declines, though older cars are falling in price at a somewhat greater clip. All age brackets have seen their Price Premium fall for at least the past five months. As the strike starts to bring down inventories of Big 3-produced domestic brands, new and used car prices have yet to increase – but soon will.

While new car sales have increased over the past month, up by 5% as consumers reacted to the possibility of strike-related price increases to come, demand for older used cars has dampened. Sales of 8-13 year old cars fell by 4% in September, while those of 4-7 year old vehicles fell by 3%, as still-elevated interest rates and dwindling pandemic-era savings place more constraints on consumers.

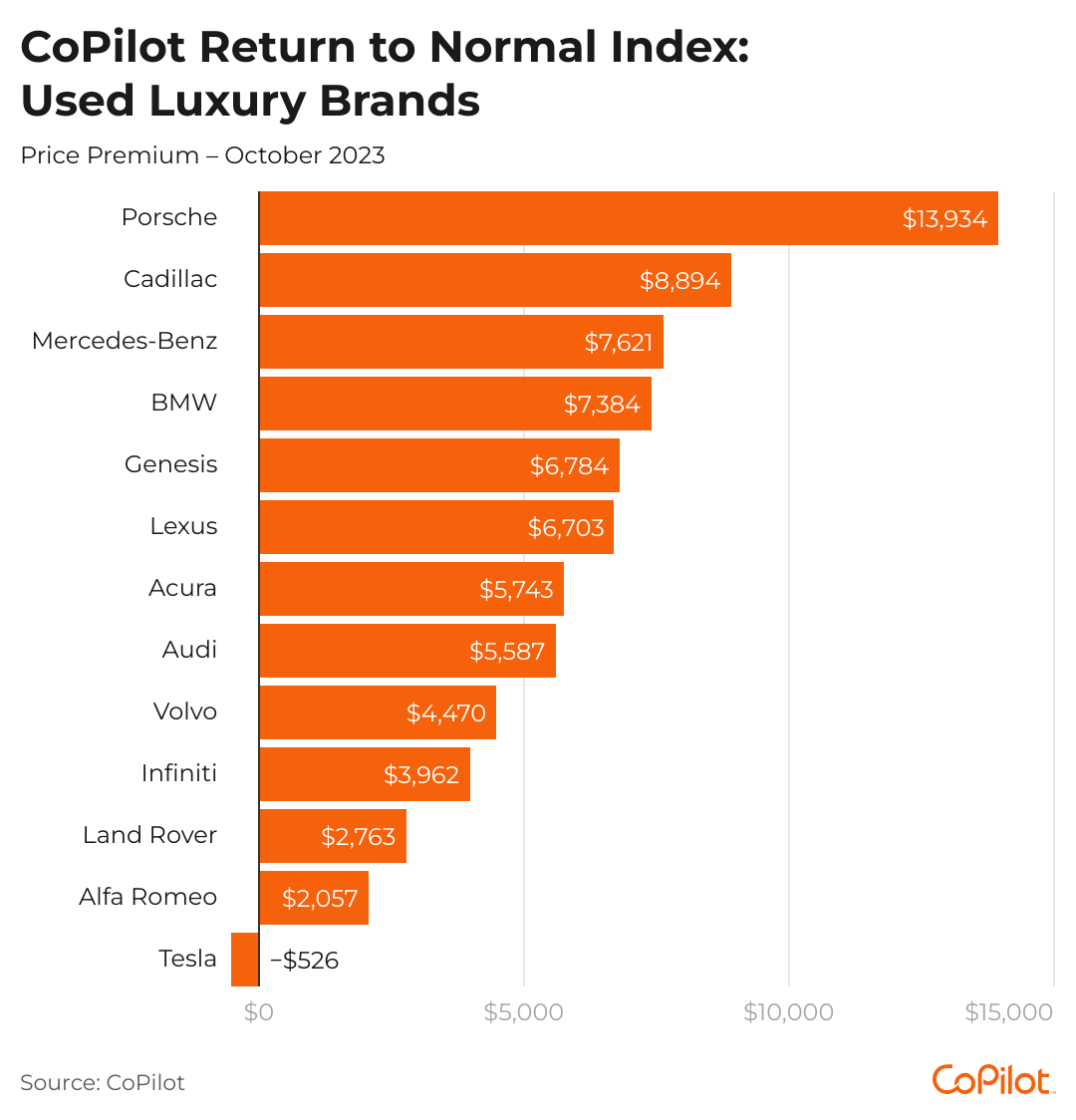

Are EVs Still The Best Value In The Used Market?

Used Teslas remain one of the consistently best values in the used car market, as the only brand in CoPilot’s Index that is currently priced below normal levels, at priced $526 (or 1%) below normal. Since Tesla first announced price cuts in late December 2022, average prices of its used models have fallen by a total of $11,533 (or 22%).

However, amid surging demand and dwindling supply, used electric vehicles overall actually increased in price in September. Used electric vehicles had an average listing price of $42,804, up by $524. This represents the first monthly increase in price for the first time in over a year, as used EV sales have increased by 25%, and market days supply has fallen by 22%, since July. At 82 market days supply, new EV inventory remains considerably elevated, as consumer interest in EV stagnates despite price drops and government incentives and tax rebates.

This story was produced by CoPilot and reviewed and distributed by Stacker Media.