4 Charts That Show Used Car Prices Are NOT Returning to Normal Any Time Soon

Sales volume and prices in the used car market have surged since the start of the year, and show no signs of a slowdown. Driven by the higher end of the market, newer vehicles and more expensive makes and models like SUVs, used car sales and prices will likely remain strong through the traditionally busy summer buying season.

Using its PricePulse data set, CoPilot measures the difference between what any used car price would have been today, if not for the extraordinary dynamics of the past two years, versus how much it is actually worth now, at retail.

CoPilot

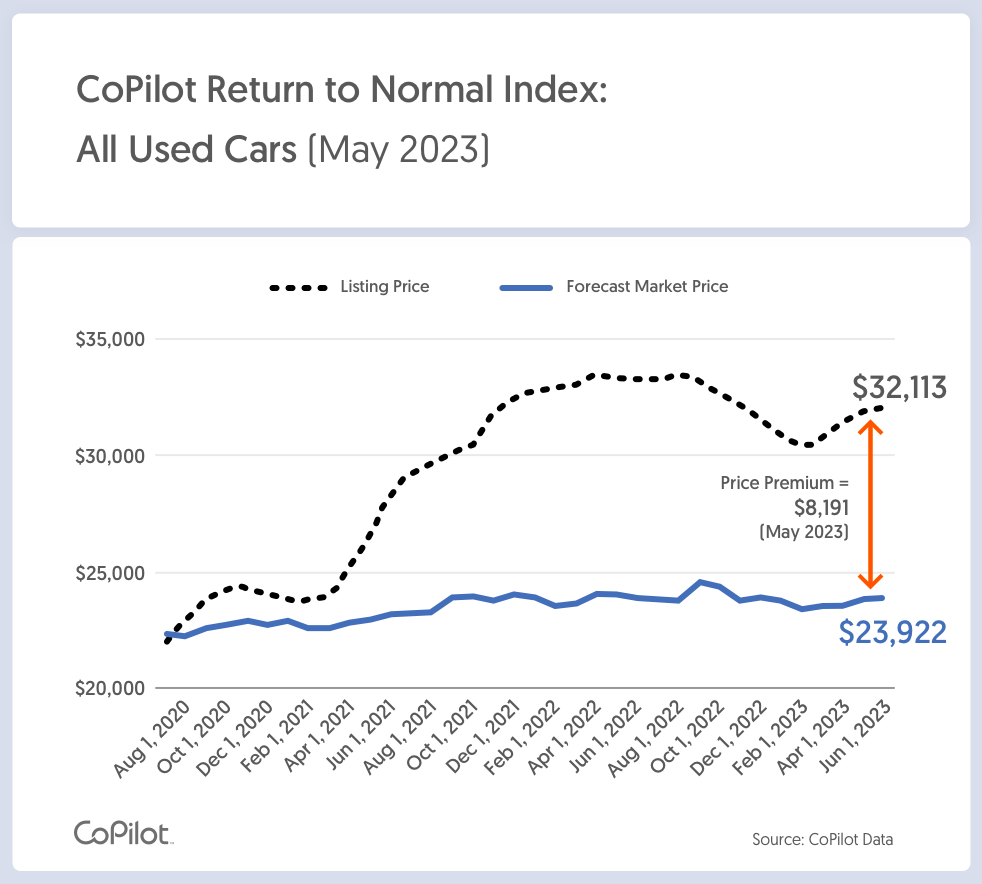

Forecasted Used Car Prices and Actual Listed Price Show Significant Gap

As of June 1, 2023, used car prices increased for the fourth consecutive month in May, but at a slower rate than in April. Used cars were listed at an average price of $32,113 in May, up $194 (or 0.6%) since April. Amid strong consumer demand and confidence, particularly among more affluent consumers who continue to benefit from pent-up pandemic-era savings, used car prices have increased by $1,693 (or nearly 6%) since February.

“As soon as prices dip even a little bit, or dealers offer any kind of discount, buyers are swooping in,” said CoPilot CEO and Founder Pat Ryan. “Buoyed by still-strong consumer confidence and pent-up pandemic-era savings, more affluent buyers are showing no hesitation to pay near-record-high prices for the priciest vehicles on the market. This strong demand at the upper end of the market is making used cars more expensive overall, especially compared to where we would expect them to be in a non-COVID economy. As a result, it’s unlikely we’ll see the used car market return to normal any time soon.”

CoPilot

DOWNLOAD THE FREE APP

The CoPilot car shopping app is the smartest way to buy a car. Get a curated list of the best cars for sale in your area, as well as notifications if a similar vehicle is listed nearby at a lower price. CoPilot is the smartest way to shop for used cars.

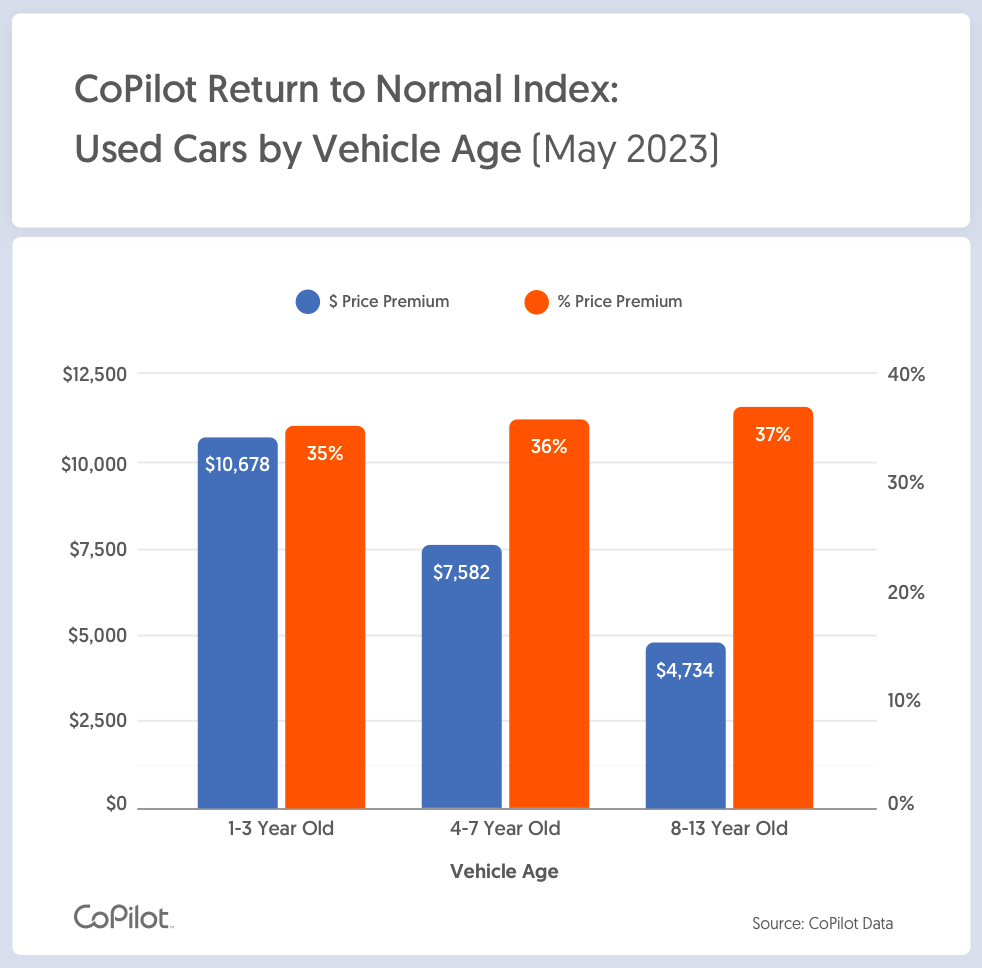

Price Increases Are Highest For Newer, More Expensive Cars

Prices of 1-3 year old vehicles dropped by a mere $225 in the past month to an average of $41,057, their sales jumped 9% in May, fueled by a strong Memorial Day weekend. With their average price hovering above $40,000 for the fourth consecutive month, these nearly-new vehicles are a strong indicator of robust consumer confidence and resilient demand, which will keep inventory low and prices elevated for the foreseeable future.

At the older, less expensive end of the market, tightening credit standards and higher interest rates are making vehicle purchases even less affordable in real terms. This part of the market is experiencing an inventory shortage, with dealers’ supply of 4-7 year old and 8-13 year old cars reaching near-record lows, of 35 and 28 days, respectively. This is a trend that has been consistent throughout the pandemic: Since 2019, the proportion of used cars priced under $20,000 has fallen by half, from 53% of the used market to just 27% today.

“Headed into the second half of the year, we will continue to see tension between interest rates and strong consumer demand,” Ryan said. “While demand is incredibly high at the upper end of the market, consumers who rely on financing are struggling not only with increasing interest rates and more limited financing options, but also with the reality that there are fewer and fewer affordable vehicles on the market. Consequently, sales of older cars have fallen in the past several months as many consumers find themselves priced out of this part of the market.”

CoPilot

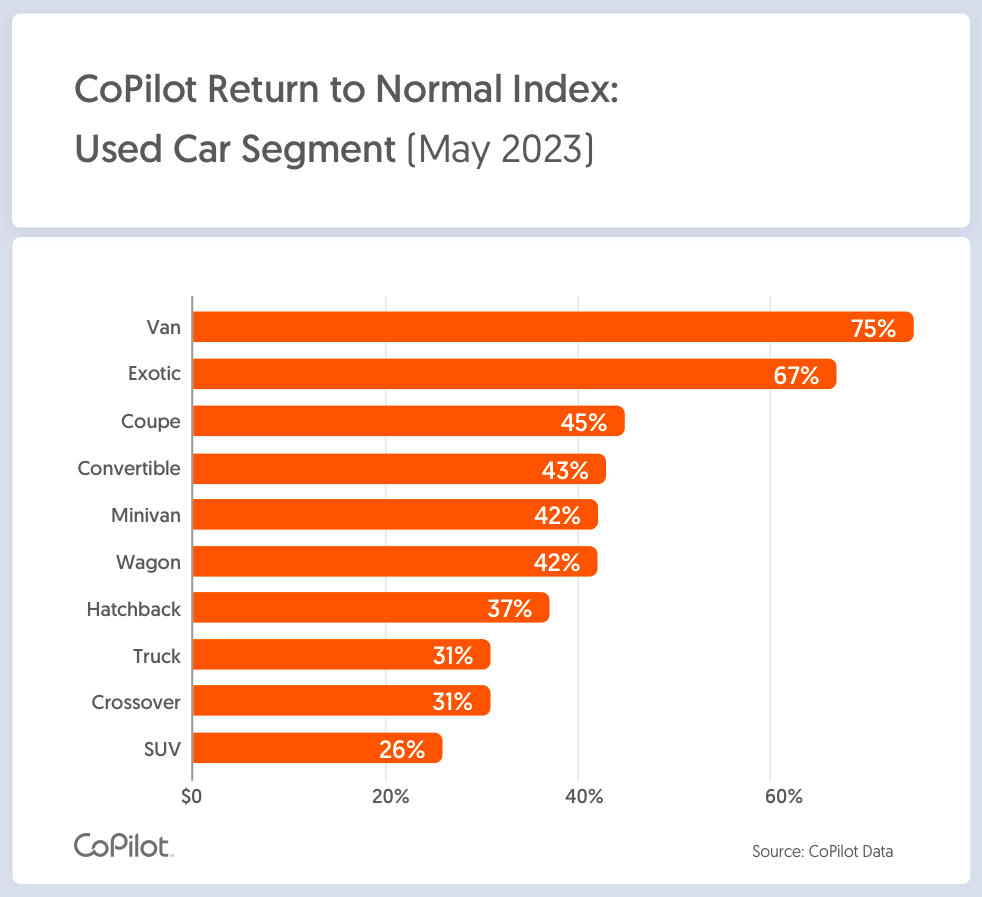

SUVs Lead Price Surge, Up A Staggering 9% In Three Months

More expensive vehicle segments, particularly SUVs, lead the market’s continued surge. Used SUVs – now on average $43,652 – have increased in price by $3,502 (or 9%) in the past three months alone. They are priced $9,076 (or 26%) above normal levels, a 53% increase in their Premium in that same time period.

Minivans increased in price for the second month in a row, now listed at an average price of $25,045. This represents a price increase of $541 (or 2%) since April. This marks the fourth consecutive monthly increase in Premium for used minivans since February. The average listing price for used pickup trucks was $41,529, up 0.7% (or $283) since April. This marks the third consecutive month in which used pickup truck prices increased. Despite this increase, used pickup trucks remain the segment second-closest to returning to normal levels, on a percentage basis.

CoPilot

OTHER CAR SHOPPING APPS ARE OUTDATED

You won’t realize how outdated other car searching apps are until you try the CoPilot car shopping app. CoPilot does the hard work for you by searching all of the listings in your area and intelligently creating a personalized list of the best buys in the area that match what you’re looking for.

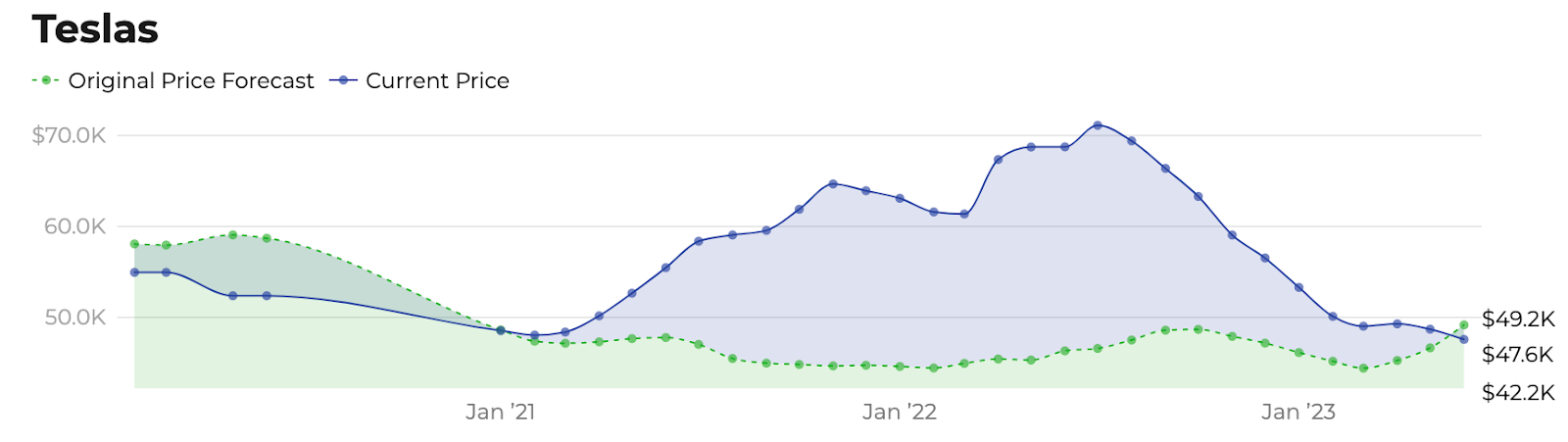

Teslas Is The Used Car Market’s One Bright Spot

Since last summer, prices of Teslas and other electric vehicles have declined in tandem with gas prices, which peaked in July after a run-up in the spring of 2022. Used Tesla prices continue to plummet, dropping 33% (or $23,500) since last summer’s peak, and down 8% (or $3,944) since the EV pioneer first announced price cuts to some of its new models in January 2023. In May, used Teslas, with an average price of $47,578, have become the first brand to reach normal price levels, now listed $1,598 (or 3%) below projected normal levels.

“A used Tesla is a screaming bargain, down 33% compared to a year ago, even as comparable gasoline-powered cars are going up in price,” Ryan said. “But buyers need to be on their toes because Elon Musk’s approach to pricing and discounting is disrupting the entire market, bringing unprecedented volatility as new Tesla price changes flow through to used models, and force reactions from competitors.”

This story was produced by CoPilot and reviewed and distributed by Stacker Media.